Feature Story

Reacting to the future

Investors in a post-crisis world need to start looking ahead, instead of reacting to what has already happened. We uncover the potential sector winners and losers of the pandemic, and where the opportunities might lie.

Opportunity in automation

Automation has transformed businesses and customer interactions in recent years, and the pandemic has created fertile ground for it to flourish, presenting potential new opportunities for astute investors. We take a closer look at what it means both for those driving automation innovation and for those consuming it.

What's behind the growth in automation?

"Multiple sectors are embracing automation, from manufacturing through to retail and services," says Kevin Lyne-Smith, Managing Director, Global Head of Equities, HSBC. "Pressure to reduce costs and meet customer demand for responsive and improved service are clear drivers, but the growth of enabling technology, and demographic factors also propels investment. Countries where cheap labour is readily available make it hard for companies to justify that level of investment."

What are the benefits?

Upfront costs aside, investing in automation may lead to greater return on investment (ROI) for businesses in the long-term, helping to support efficiencies and potentially lowering a company’s cost base. Quality and reliability improvements can reduce waste, fewer staff are required and, the UN reports, firms adopting advanced digital production technologies are more productive, competitive and efficient.1 In high-risk industries, automation can improve working conditions and health and safety, providing additional reputational benefits for firms.

Whilst lean processes can improve the working capital cycle, data gathering and analysis offers opportunities for companies to respond to changing customer needs, improve the customer experience, predict demand more accurately and streamline their operations. All providing a competitive advantage and potentially improving market share, boosting the cost-to-income ratio and mitigating risk; important considerations for investors.

Why now?

"Enabling technologies, such as 5G, increased computing speed and capacity and growing demand, are all factors driving innovation and adoption," says Kevin.

In addition, COVID-19 has highlighted the frailty of systems, processes and services that rely on human labour. "The pandemic has increased company awareness of their risk exposure and the need to mitigate that, as well as reduce costs," says Bryan O'Carroll, Senior Equity Specialist, HSBC Private Banking. The need to isolate and social distance has created a situation where automation that reduces human activity and input becomes even more desirable.

"Companies that have done well during lockdown are those set up to deal digitally, where automation was second nature. Those that weren't have suffered, so when they look to the future and they're considering risk, that will be a key consideration," Bryan continues.

"The pandemic also exposed the vulnerability of global supply chains, particularly their reliance on manual labour," he explains. "The ability to automate production lines or operations offers supply chain continuity."

And it's not just in manufacturing. Reducing human interaction poses issues for retail and service sectors, for example, in the number of touches each item encounters and the use of cash. The use of automated picking and packing or service bots to channel enquiries is likely to increase.

"There's growing interest in automation to future-proof businesses against threats of this nature," says Bryan, with trends that would perhaps be five or 10 years in the making, suddenly accelerated. "Areas such as online shopping, contactless payments and even leisure activities have become increasingly automated and digitalised. Businesses have had to adapt to this new normal."

What are the future opportunities?

"Companies will have to adopt a more technological, digital approach or risk being left behind," says Bryan.

"The signs are already there," adds Kevin. "With borrowing rates at zero, corporates have already raised USD1 trillion for their war chests.2 While some of that will be for M&A, many will be rethinking their business structures to increase resilience and respond to investor concerns."

There's also growing interest in companies innovating and producing the technology. "We're already seeing some M&A activity going on," says Kevin. "Smaller leading-edge technology companies are proving tempting targets for cross-border acquisition."

Existing interest in automation is likely to grow as the global pandemic runs its course and highlights the benefits of solutions that reduce human involvement and costs across sectors. Established businesses looking to bolt-on innovative automation solutions will be actively looking for opportunities and new businesses will be emerging to drive R&D forward. For investors keen to keep pace with shifting trends, automation could offer significant potential.

1United Nations Industrial Development Organization, Industrial Development Report 2020

2FT.com, Top-rated companies raise $1tn in 5 months to fill ‘war chests’, May 2020

Wealth Planning

Lasting legacies start with open conversations

Despite the emotional and financial benefits of legacy planning, it remains a challenging topic. So much so that discussions around it are even considered out of bounds in many cultures. How will coronavirus change our attitudes towards starting productive family conversations, and what help or advice is available to guide these important decisions?

Taking a holistic approach to legacy and future prosperity

Above all else, it's crucial not to lose sight of the fact that legacy is about far more than financial wealth: it's also about looking to ensure the happiness and prosperity of your loved ones in a broader sense, for years to come.

Having open and constructive conversations as a family can benefit the senior generation and allow children and grandchildren to forge their own paths – potentially at a tangent from the family business or even completely separate from it.

If they are philanthropically minded, the discussion might be about setting up a trust or foundation in the family name, that they can run in the future.

If, on the other hand, they have an entrepreneurial streak and want to start a business, it may be a case of providing practical advice along with seed capital. Either way, the key to any of these scenarios is honesty and open-minded conversations; and to have them as early as possible.

Articulating your values to the next generation

Discussing your wishes with your family will allow you to communicate your values, which will form an important part of the legacy you leave. This can be extremely helpful for the next generation, not only on an emotional level but on a practical one as well.

"It's easy for the next generation to make assumptions if they aren't privy to all the necessary information," says Alan Beattie, Global Head of Private Wealth Solutions at HSBC Private Banking.

"For example, children often feel that they should keep a business in the family, even when their skills and motivations lie elsewhere. Or they may shy away from trying to innovate or diversify in the belief that this would show disregard for the legacy of their forebearers."

Even if you pass on wealth with no caveats and conditions, without a clear and unequivocal understanding of what their benefactor would have wanted and the legacy they wish to leave behind, heirs can be averse to taking even mild risks with their inheritance.

"On a personal level, those who inherit are often inhibited by a feeling that money, and especially assets such as property, are not really 'theirs'," explains Alan.

Communication is a key element to a family successfully navigating difficult times. We advise clients who are senior members of a family to think about taking this opportunity to have productive conversations, passing on what you have learned to others. If you are a younger member of a family, or are likely to inherit wealth, be ready to listen and use the time to expand your knowledge on the matters you are likely to encounter in later life.

Overcoming barriers

The same philosophy applies to the more tangible aspects of estate and legacy planning, such as creating Wills. In fact, in the US more than 40 per cent of adults have no written Will. In the UK that figure rises to 60 per cent, while in China the percentage of the country's 220 million senior citizens who have not written a Will is estimated to be as high as 99 per cent1.

There are plenty of reasons for avoiding this discussion, not least because it is uncomfortable. We may also convince ourselves that rising life expectancy, 21st century medicine, private healthcare, and a life free from danger make us almost invincible.

"It may be tempting to postpone critical decisions but having difficult conversations sooner rather than later is always preferable," says Alan. "Doing so will increase transparency, improve understandings and facilitate harmony."

Even if you have prepared a Will, discussing it with your heirs is still a valuable exercise in itself, as Alan emphasises.

"Discussing wishes and plans will help bring legal documents to life and give them the full sense of purpose, legacy and values associated with your wealth," he explains.

What's more, discussing your wishes with your loved ones provides an invaluable opportunity to talk about the value of wealth, how to manage it appropriately and who they can trust to advise them. Often this helps to set minds at rest on both sides.

HSBC Private Banking has been supporting the world's most influential families with wealth transition and succession planning for generations. Our international presence helps us to deliver solutions that can be tailored to your specific requirements, as well as meet the needs of international families.

We offer a full range of services including trusts, wealth planning, estate planning, philanthropic advisory, family governance and family office advisory; all to assist business families in sustaining their success.

1https://www.nationthailand.com/opinion/30362176

Entrepreneurship

The eternal optimist: finding the bright side in an impossible situation

Serial entrepreneur Roger Wade isn’t used to standing still. COVID-19 lockdown may have forced him to take a breather, but it’s also given him the chance to take stock and focus on long-term opportunities. More motivated to work than ever, Roger shares his insights on taking the positives from a challenging situation.

During this time, I also had a little bit of a health scare and that makes you start to evaluate your life differently. I saw a quote from the Dalai Lama the other day, I think it said, "We spend our whole time sacrificing our health to make money and then the rest of the time sacrificing our money to regain our health" – which just seems crazy.

Shifting priorities

It's certainly made me think about the way we want to do business in the future. I set up Boxpark back in 2011 as the world's first pop-up mall, but it's evolved a lot since then. Our shipping containers now house restaurants and leisure concepts as much as retail pop-ups.

I think we've been in a lucky enough position to really help our staff. We haven't had to make any redundancies, because we've had the support of the Government in terms of the furlough scheme, which has been great.

Our single biggest concern was our tenants. And one of the first things we did, literally the day lockdown was announced, was saying to our tenants, "Look, for the period of the lockdown, you won't have to pay rent and service charges." And this new understanding of how we can help our staff and how we can help our tenants in the long run, we hope will stand us in good stead.

Taking stock and seizing opportunity

When a crisis like this happens, you have to take a deep breath, and not rush into anything. I try to appreciate what I've got rather than look at the negatives. We've got a strong business, we've got really good cash reserves, we can comfortably survive 12 months of lockdown. That's not the same for all businesses, so that's really positive for us. And, now, coming out of coronavirus, we're in a strong position because we're focused on kitchen-only operations, which you can do delivery and takeaways from, and we have a lot of outdoor spaces, too, unlike many restaurant and bar operators.

Don't get me wrong, it's obviously had a massive impact on our business, because we've had to close all of our sites – Boxpark Wembley, Boxpark Shoreditch and Boxpark Croydon. Last year, our profits doubled, our turnover year-on-year had grown 50 per cent, we were doing very well as a business. We were also on the verge of a major private equity deal where I was going to sell a part of my shareholdings – so it had a massive impact. But, I'm always a bit of a glass-half-full type of guy, I'm optimistic. I actually believe in the long-term that coronavirus and the implications could be good for us.

We are going to see a fallout in terms of the number of hospitality and leisure businesses that survive, but that could lead to a new order. Bigger businesses that have huge overheads will not be able to cope with the rental demands and paying salaries when they also have to deal with social distancing. In the short term, it's negative for Boxpark and it's negative for other businesses. But in the long term, it could mean that we can get better sites at more realistic prices. We could get better staff and I think we can fill the vacuum that's been left behind by some of the big brands.

New revenue streams

Before going into COVID-19, we were looking to bring office developments into Boxpark, coworking spaces, and I still believe in that model. The idea that we all need to be based in one central big head office - those days are numbered. I'm not saying they're over, but increasingly you're going to have company directors who feel they can allow staff to work in co-working spaces, or work from home, and have a lot more satellite offices.

Coming out of COVID-19, we're still keen to put co-working spaces above Boxpark, because effectively that would give people the flexibility of working in different places, maybe closer to where they live. Building a couple of stories of offices above us makes sense. We cater for the office worker during lunchtime and after office hours and for people at the weekend, so it seems to be a complementary approach.

Finding the bright side

I guess optimism is a personal trait. I'm always trying to be positive and I believe that things will go back to how they were. Yes, there will be some change, but by and large, we will return to normality.

You've got to look at these challenges as a creative opportunity to reinvent yourself and that's what we've been doing. We've been looking at things like developing apps that allow click and collect, rolling out turnover rent, looking at our POS integrations, and generally just looking at the bright side of things.

We're all in it together, not individually, and if we can survive this, we could perhaps grow stronger on the other side.

Meet Toshi Nakamura, co-founder of social enterprise Kopernik

‘The most important ingredients of success is persistence.’ Toshi Nakamura shares his keys to success.

Cybersecurity

When everything becomes digital

With COVID-19, home internet activity has risen at an unparalleled rate to meet our everyday needs. The increased internet use also comes greater risk. How do we stay vigilant with cybersecurity?

Increasing internet use and an ever-expanding digital footprint expose your personal data and privacy to potential cyber-attack. Forbes estimates that home internet usage has increased by up to 70 per cent, and an MIT Technology Review cites that COVID-19 is driving the most rapid expansion of the Internet in decades.1 Cyber criminals have even unearthed old scams and repackaged them for the COVID age to lure vulnerable users, with common attacks involving impersonation of the World Health Organization (WHO), the Centers for Disease Control and Prevention (CDC), and US Government stimulus programs amongst others. Google alone states that they block an average of 18 million phishing and malware emails a day related to COVID-19 as of April 2020, and closer to 100 million phishing emails in total.2

The cost to consumers

Cyber criminals continue to be motivated by the significant profits they reap when their attacks are successful. According to the Federal Trade Commission, US consumers have already lost USD25 million to 'COVID-19 themed' fraud and identity theft incidents through May 2020.3 And these figures will likely continue to increase. Consider the FBI's Internet Crimes Report which recorded USD3.5 billion in losses to cyber-crime in 2019 alone.4 Wealthy individuals and those in high profile industries are at a higher risk of fraud and identify theft due to the prominence of their online profiles, frequent international travel, highly digitised home environments, and the broad network of service providers that provide assistance to them and their families. A study by Camden Wealth and Schillings identified that 28 per cent of family offices in 2018 were victims of cyber-attacks, a number expected to have risen in 2019.5

The cost to businesses

Businesses also remain frequent targets of cyber criminals, and for them, the costs of recovery can be staggering. IBM estimates that globally, data breaches alone cost companies an average of nearly USD4 million in 2019. In the U.S. the average cost was more than double that, at USD8.19 million.6 According to Coveware, a ransomware negotiation and remediation firm, high ransoms pushed the average ransom payment in Q4 2019 to USD84,116, doubling the prior year's average. The global research firm Cybersecurity Ventures estimates that annual global cyber-crime costs could reach USD6 trillion by 2021 — representing a figure more profitable than the combined global trade of all major illegal drugs.7

Top 10 Tips

Making cybersecurity a top priority

You can take steps to help safeguard your reputation, personal data, and privacy.

Here are our top 10 tips to follow, both on and off the internet:

1. Wi-Fi Safety

Home Wi-Fi networks with weak, unchanged or reused passwords are continuously under threat. Make them strong, and change them periodically. Public Wi-Fi and unsecured private networks like those you see in airports and hotels for example, are vulnerable and frequently targeted — it's best not to use them.

2. Children and Online Education

Where children have had to rely on their own computers for educational purposes, they may be running them without the latest software installed or without having been scanned for malware or viruses. Also, not all security software provides an unbreakable stronghold; it's best to use verified and official software to enhance security measures, such as a VPN connection to classified servers or encrypted FTP SharePoint.

3. Password Managers and 2FA

It can be difficult to juggle so many passwords in the name of safety — consider a password generator and manager to keep track, and turn on two-step verification (2FA) for every available platform you use. Using additional security questions for your accounts helps prevent fraudsters from impersonating you in a log-in attempt.

4. Video Communication

The communication platforms we are relying on more than ever are in high demand, and are vulnerable to malicious attacks. Some are safer than others; try to use platforms that offer password protection to keep communications private and prevent intruders.

5. Monitor Accounts and Set Up Alerts

Keep a close eye on your accounts and portfolios. It's useful to set up a real-time dashboard that can actively monitor your information and alert you to any unusual transactions.

6. Use Encrypted Email

Consider purchasing or upgrading to an encrypted email system. This will help to prevent data leakage from your email communications and may offer other features to block phishing attempts and malware attachments.

7. Avoid Emailing Highly Sensitive Information

As suggested above, email is not the most secure form of communication for especially sensitive transactions that involve bank or investment account details.

8. Be Wary of Urgent Requests

Don't fall prey to scammers. They use tactics that are designed to scare you and convince you that you have to act quickly on a threat or opportunity. Always check the source of the information first, whether that means calling your bank or other advisors to verify the request or determine if it's a scam. It's not likely your bank will change your account details at short notice or ask you to disclose your password or other details by email. Be wary of these kinds of communication and always verify account information or instructions in person or via phone, using your usual contact numbers.

9. Be Wary of Unexpected, Unfamiliar Opportunities

Scrutinise investment opportunities from unfamiliar sources, and be sure to vet and verify the authenticity of these opportunities. Even official-looking email links can lead you to malicious or duplicate sites designed to harvest your personal details or dupe you into false investments.

10. Have a Recovery Plan

Back up your data regularly, and know in advance whether or not you would pay a ransomware demand if your personal information or data are hijacked. More often than not, stolen information is either deleted or otherwise irretrievable, even after paying the ransom.

Despite even the best intentions and practices, something can go wrong. Cyber criminals are constantly using new techniques and technologies to find vulnerabilities and stage their next attack. The best defense is being proactive using the tips above, backing up your data, and introducing additional security — such as a cyber insurance policy designed for individuals and families of significant wealth. To find out more about the kinds of insurance that are available within the industry, contact your Relationship Manager. At HSBC Private Banking‚ we are committed to helping you keep your data and your assets safe in every area of your digital life.

1https://www.forbes.com/sites/markbeech/2020/03/25/covid-19-pushes-up-internet-use-70-streaming-more-than-12-firstfigures-reveal/#34b7b9823104; https://www.technologyreview.com/2020/04/07/998552/why-the-coronavirus-lockdownis-making-the-internet-better-than-ever/

2https://cloud.google.com/blog/products/identity-security/protecting-against-cyber-threats-during-covid-19-and-beyond

3https://www.ftc.gov/system/files/attachments/coronavirus-covid-19-consumer-complaint-data/covid-19-daily-publiccomplaints-050520.pdf

4https://www.fbi.gov/news/stories/2019-internet-crime-report-released-021120

5https://www.forbes.com/sites/francoisbotha/2018/11/10/why-family-offices-need-to-prioritize-cybersecurity/#1903523d601a

6 https://www.ibm.com/security/data-breach

7https://cybersecurityventures.com/hackerpocalypse-cybercrime-report-2016/

Insights

Why transition finance is essential

Helping high-carbon companies transition toward net zero emissions is a vital part of combating climate change – and banks, investors and policymakers must step up their support.

Daniel Klier, Global Head of Sustainable Finance, HSBC, said: “Sustainable finance has had a tremendous impact on the development of clean technologies such as wind and solar power. We are seeing the start of a large-scale shift to renewable energy. But to achieve the ambitions of the Paris Agreement, the financial sector must help businesses in high-carbon sectors find a way to make the transition towards net zero emissions.”

High-carbon sectors are sometimes called ‘hard-to-abate’ because achieving significant reductions in emissions is technically challenging or requires major investment.

Many key industries need to undertake long-term change to become zero-carbon. The energy system and transport, including shipping and aviation, need to transform. Heavy industries such as chemicals, steel, and cement must significantly reduce their emissions. And even the homes we live in – where we use energy for cooking, heating and cooling – will need to evolve over time.

Businesses in these sectors may need to undertake complex transformations to reduce their carbon emissions, often in a series of phases. Traditional forms of sustainable finance are not always a good fit for these transitional phases. For example, an airline company may use a green bond to finance research into biojet fuel – but investors may not be willing to accept the financing of a new, less carbon-intensive fleet of aeroplanes.

How transition finance can help

Transition finance means any form of financial support that helps high-carbon companies start to implement long-term changes to become greener. It bridges the gap between traditional and sustainable financing as businesses begin the journey to net zero.

As HSBC’s whitepaper explains, transition bonds have the potential to provide a significant amount of this support. These bonds raise funds from investors, with the proceeds earmarked to help businesses cut their overall climate impact. This could include investing in low-carbon technology, or redesigning energy-intensive processes. For credible transition bond issuance, issuers should disclose a net-zero target and a strategy for long-term decarbonisation.

Incorporating environmental targets in bonds and loans could also be a useful tool, creating a further incentive for companies to cut emissions. For example, a business issuing a three-year bond could commit to cutting its overall carbon emissions by 10 per cent over those three years – and agree to pay investors a premium if it falls short of that target. Instruments incorporating environmental targets in this way are sometimes called ‘sustainability-linked’ bonds and loans.

Agreeing clear standards and benchmarks for products such as these are among the steps that could accelerate the development of the transition finance market, the paper concludes.

You can find further insight on the low-carbon transition from HSBC executives and external experts by visiting the HSBC Centre of Sustainable Finance website.

Biodiversity in the balance

The degradation of the natural world threatens economic prosperity. It is in investors’ interests to step up and protect the planet.

Most damaging of all, of course, has been COVID-19 – a consequence of our increasingly close contact with hitherto remote ecosystems. The pandemic has revealed the massive and unpredictable interconnectedness between natural environments and global economies.

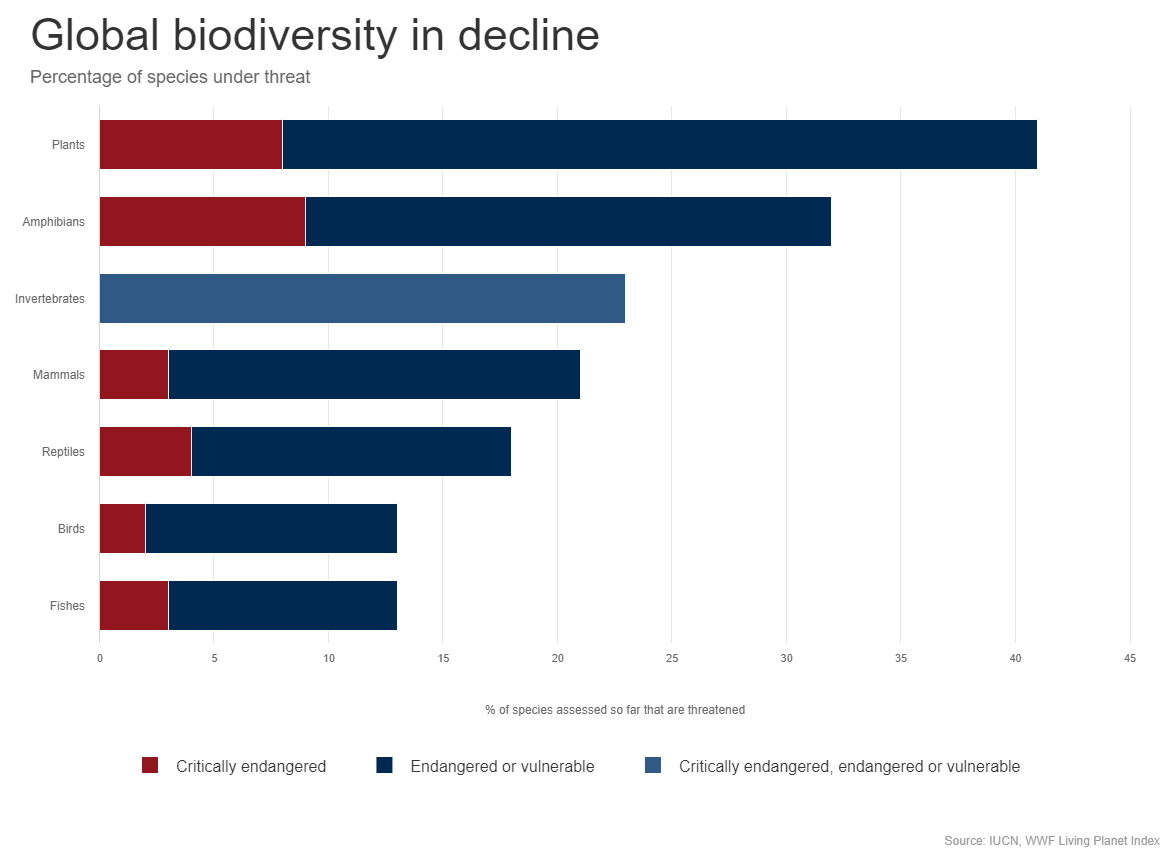

Damage to ecosystems across the world, and the resulting loss of biodiversity, has received less attention than other sustainability challenges – climate change risks, pollutants, poverty and conflict. Yet the biodiversity crisis is a direct risk to humankind. It is hard to quantify given the heterogeneity of ecosystems, and it is very hard to solve. However, what is certain is that we have not found a way to continue to grow and develop that interacts with the natural world in a sustainable way.

The effects of human action on the natural world are profoundly damaging: deforestation; land degradation; pollution of the water, air and soil; hunting and harvesting; and climate change. And as our population increases and our pursuit of economic growth continues, so the threat intensifies. We lost an average of 60 per cent of the population of vertebrate species between 1970 and 2014. Three-quarters of the land on earth has been ‘severely altered’ by human actions, as has two-thirds of the marine environment. Around a million species are at risk if we do nothing.

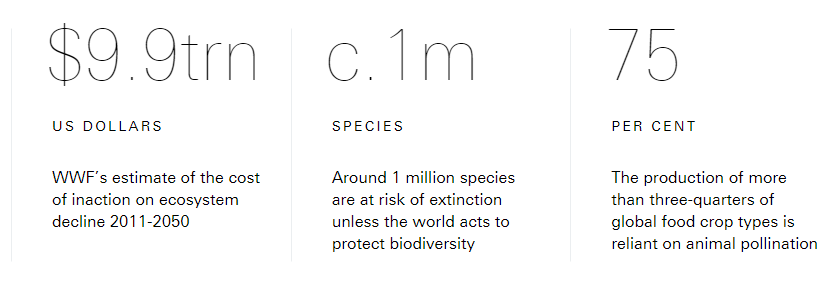

Our dependence on biodiversity for food, raw materials, medicine and weather regulation makes this trend extremely worrying. Around 70 per cent of cancer drugs are organic or derived from natural products, for instance. Production of over 75 per cent of global food crop types relies on animal pollination. In economic terms, the WWF estimates the cost of inaction on ecosystem decline at USD9.87 trillion over 2011-2050.

Like many sustainable development challenges, protecting and restoring biodiversity remains extremely complex - for investors, policy-makers and communities around the world. So perhaps there is a risk, that as policymakers and companies focus on tackling COVID-19, and then on increased debts, balance sheet damage and weak profits, that other sustainability issues might get pushed into the background.

However, as we seek to build back better from the current social, economic and environmental crisis, we have an opportunity to integrate an urgent and sizeable response to the biodiversity crisis at global and systemic levels. And we think investors can take a lead in three key ways.

First, they can support the development of a robust methodology for measuring biodiversity loss, conservation and enhancement. More data will allow the measurement of biodiversity risks, and enable markets to integrate these in valuation.

Second, investors can allocate assets towards companies which operate in environmentally sustainable ways and which produce biodiversity-positive technologies. A simple analysis contains evidence to suggest that such companies have outperformed in recent years.

And third, asset management firms should embed biodiversity protection at the heart of their approach to responsible investment through engaging with issuers, proxy voting and disclosure.

If anything, the pandemic should accelerate the focus on sustainable investing, rather than distract from it. While governments are fire-fighting, investors can step up and play a pivotal role, with potential long-term benefits for themselves – and for the planet as a whole.

Asia’s age challenge

Asia’s changing demographics make it even more important for people to plan for the future – and the insurance industry must adapt to support them.

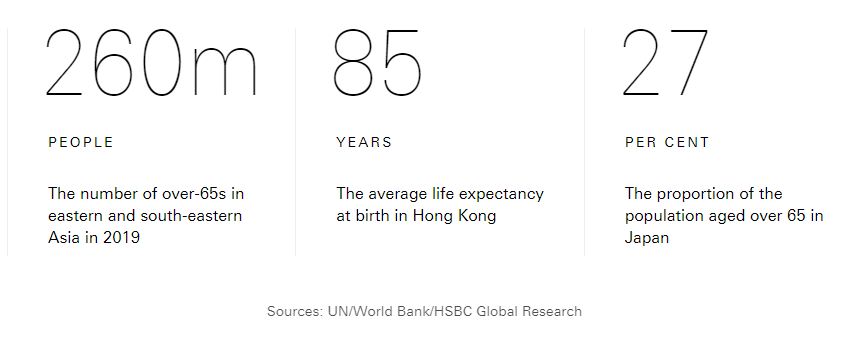

That’s more than in any other geographic region worldwide. And this figure will more than double by 2050, according to United Nations projections.

Leading the way is Japan, where more than one in four of the population is over the age of 65. In the next five years, Hong Kong, Taiwan and South Korea are also expected to become ‘super-aged’ societies, with more than one in five people in this higher age bracket. And Singapore is set to experience a 21 percentage point increase in its share of older people by 2050 – one of the biggest rises worldwide.

Increasing life expectancies often reflect improved living standards and better access to medical care. Longer lives are giving many people the opportunity to spend more time enjoying retirement and playing an active role in their community.

But ageing populations bring challenges too. How will people fund their lifestyles long after they stop work? How will healthcare systems cope with the rise in age-related illnesses? Who will step in if people can no longer look after themselves?

Such concerns are particularly pressing in countries and territories where public provisions are limited, and where low birth rates mean there are fewer young people to support older generations. In mainland China, for example, the birth rate dropped to its lowest level in seven decades last year, despite the easing of the one-child policy, according to the National Bureau of Statistics.

There are no straightforward answers. Many organisations will need to be involved in finding solutions – including governments, employers and financial institutions. Individuals are also likely to need to take steps to prepare for their own future, especially if they cannot rely on their children to provide for them.

The insurance sector has a role to play here. Demand is already rising in Asia, with mainland China on course to become the world’s largest market for insurance. The insurance industry needs to meet that demand – and also anticipate people’s changing requirements, in three key ways.

First, insurers are developing new products to help people access support that they may be more likely to need later in life. In Hong Kong, for example, HSBC has launched a product that provides protection if the policyholder is diagnosed with dementia – a condition which now affects around 50 million people worldwide.

Second, insurers can help people develop healthy habits that will give them a better chance of enjoying their extra years of life. Many are introducing products that incentivise customers to take part in health-boosting activities, such as taking regular exercise, and track their progress using wearable technology.

Third, employer-sponsored health and life insurance benefits, which have long been popular in western society, are likely to have a greater role to play in Asia in the years to come. A closer relationship between insurers and employers could make it easier for individuals to make good choices and start saving earlier.

Grappling with the challenges posed by these demographic shifts will require input from many different sectors of society. Insurance is only part of the solution. But the right planning can give people greater peace of mind for the future.