The Power of Purpose Making meaning out of life

Now, more than ever, a clear sense of our own deep-rooted values can empower us to make the right choices in both our personal and professional lives. Wealth means more than just money. It offers greater access to the world around us, but often prompts periods of self-reflection on what fulfilment means. It will also equip us with the knowledge of how to meet difficult conversations head-on, expand our horizons and master our own happiness.

Feature Story

A world of difference: Thriving through community

In light of the challenges facing global society, a need for community and shared values has perhaps never felt more important. As part of our aim to connect you with new ideas, opportunities and networks, we explore how you can expand your horizons and harness your entrepreneurial spirit to help others while gaining a renewed sense of purpose.

Contributing your entrepreneurial skills and professional experience to the world of social enterprise is an excellent way of making a difference to others while making all the difference to yourself. Becoming a social entrepreneur can give a real sense of purpose and meaning across your professional and personal life, but as an individual it can be difficult to know where to start. We hope the ideas we present here will help motivate you to explore how you can combine entrepreneurship with social responsibility to thrive both as an individual and as part of a growing global community.

Going There

“Only those that have travelled the road know where the holes are deep.” – Chinese proverb

One way to really expand your horizons is to physically put yourself in situations that are outside your comfort zone. You may be driven by a need to live your passions, or a desire to find your own path away from the obvious routes laid out before you. Or it could be you simply want to gain experience you can bring back to your ‘normal’ life and career. Whatever your motivation, there is nothing like first-hand experience.

For example, you could start researching or planning a future trip which will enable you to tread in the footsteps of your own carbon footprint, or allow you to gain a greater understanding of the potential consequences of your investment decisions as motivation to invest more responsibly. This is the rationale behind our own annual Next Generation Sustainability Leadership Programme, which gives some of our most valued clients the opportunity to go on an immersive journey from understanding to advocacy in the jungles of Borneo.

Closer to home, you could step outside your social circle and experience life with those who are less fortunate financially. For example, you might try volunteering for a homeless shelter or a charity working with underprivileged children. Philanthropy is not solely about donating money – time is another luxury which you may have the good fortune to be able to share with others, while your professional skills or entrepreneurial talent could be invaluable to a charitable cause.

By travelling out of your physical comfort zone and getting some hands-on experience you’ll be keeping good company. For example, as young men Laurance and Nelson Rockefeller, grandsons of John D. Rockefeller, worked as dishwashers on a shipboard expedition to the remote Canadian region of Labrador, a trip which is believed to have inspired Nelson’s lifelong interest in nature conservation. Meanwhile, celebrities including Ben Affleck, Selena Gomez, George Clooney and Scarlett Johansson have given their time to a wide range of aid charities, both in their home countries and in the third world.2

If you would like to get actively involved, there’s a good chance we can help through our network of contacts. Alternatively, you can find resources online, from global citizenship organisations to local food banks, and from charities focused on conservation to those promoting international development.

Doing the research

“There is no shame in not knowing; the shame lies in not finding out.” – Russian proverb

While learning through direct experience can be extremely powerful, you can of course also widen your perspective through study, whether formal or informal. For some, study offers an opportunity to gain knowledge and understanding they can incorporate into their existing life and career; for others it provides the impetus to set off in a completely new direction.

If you’re driven to pursue social entrepreneurship and philanthropy as a career there are a number of vocationally focused courses from leading global institutions, offered both online and in person, which could be for you.

If formal study doesn’t appeal, you could gain new perspectives through self-directed reading. There are plenty of books that can both provide advice and spur you to action – try the WEF’s ‘6 books to read if you want to change the world’3, or just search terms like ‘global citizenship’, ‘social impact’ or ‘social entrepreneurship’ in an online bookstore.

For those who prefer to consume information in bitesize chunks or simply want to keep up with the latest thinking, a growing number of websites and magazines such as Pioneers Post4, Rank & File5 and Change Magazine6 are devoted to social impact. A number of these sites include videos and podcasts so it’s not difficult to find material that matches your preferred learning style.

Our advice to clients, in life as in business, is keep learning, because you’ll never know enough.

Exchanging ideas

“If you want to go fast, go alone. If you want to go far, go together." – African proverb

Another great way to get both informed and inspired is to engage with people who share your interests and motivations. Seeking connections, either with those who have ‘been there and done it’ or those who, like you, are exploring the possibilities, can be both professionally useful and personally rewarding.

You can find plenty of thought leaders and successful social entrepreneurs online on LinkedIn, Twitter and Medium. Many freely share hard-learned lessons from their personal experiences, and some may even be open to mentoring or at least giving specific advice.

It’s also worth looking for connections through your family, friends and wider social networks. Tell people about your ideas and the chances are someone will know someone with similar aims who is willing to help or collaborate – after all, giving advice costs nothing and offering support can earn a friend and ally.

Remember the Rockefellers and their trip to Labrador? Laurance went on to become a major contributor to the conservation and ecotourism movement, founding the American Conservation Association, advising a series of US presidents and winning a Congressional Gold Medal for his efforts. There is no reason why you cannot have an equally positive impact on the world, if you put yourself out there. As Rockefeller himself said, ‘People who try to play it safe lead very dull lives’.7

1https://www.poemhunter.com/poem/no-man-is-an-island/

2https://www.givingway.com/blog/20-celebrities-you-didnt-know-were-also-volunteers

3https://www.weforum.org/agenda/2019/10/books-social-entrepreneurship-reading-list/

4https://www.pioneerspost.com/introduction

5https://rankandfilemag.com

6http://www.changemag-diinsider.com/who-we-are

7https://www.irishtimes.com/news/used-oil-fortune-to-become-leading-venture-capitalist-conservationist-otand-philanthropist-1.1149656

Wealth Planning

Family Businesses for Generations - Maintaining Buoyancy in Choppy Waters

Families and businesses are facing complex challenges during uncertain times. What could you do to ensure a successful transfer of wealth to the next generation and the preservation of wealth for generations to come?

How Old is Old?

Recently, Business Financing UK published an interesting piece detailing the world’s oldest companies still in business today1. A notable example is that of Ma Yu Ching’s Bucket Chicken House, which the report claims to be the oldest Chinese restaurant still in operation. First opened in Kaifeng, China, the restaurant has survived many dynasties, boasting a long heritage! Research on this topic has plenty of scope for expansion and further studies, but companies like these set an excellent precedent for multi-generational family businesses to take inspiration in pursuit of their own legacy that rides the ups and downs of history.

What have they done right?

How have they demonstrated resilience in the face of a continuously changing competitive landscape?

How have they adapted their businesses to reflect the climate of the times?

The declining life expectancy of family businesses

Family businesses deliver an exceptional amount of value to society and the economy. According to research firm Wealth-X, as much as US$15.4 trillion will be passed down from one generation through the next between now and 20302. Family businesses also contribute between 70-90% of global GDP and create 50-80% of jobs worldwide3.

But it is also true that fewer than one-third of family businesses survive from the first to the second generation; and an even smaller proportion are able to pass on their companies to the third generation4. The trend we are seeing is one where companies rise quickly, attaining impressive success, but for one reason or another do not survive a generational change in leadership. Fortune magazine reported that in the 1960s the average lifespan of a company in the S&P was roughly 60 years, whereas today it is closer to 205.

In light of this, there are important questions for family business owners to ask themselves:

Is our existing business model fit to last for 25, 50, even 100 or more years?

How can we improve customer satisfaction and loyalty while continuing to exceed client expectations?

Are we always looking for new ways of doing things and nurturing an entrepreneurial culture in our firms?

Communicating for the future

The art of effective communications is a well-researched topic. For family business owners, involving stakeholders in discussions about the business and its future is paramount. It is important that expectations about roles and responsibilities are managed and an environment of trust is created.

In the previous article, we summarised effective communications strategies for strengthening the bonds and working relationships between members of the business family. Today we would like to discuss communications in the context of the actual family business. Below are a few points for reflection:

1. Building a positive company culture

Inter-personal dynamics between stakeholders of a family business are much more complicated given potentially conflicting agendas6. To improve collaboration, developing a winning company culture, which drives employee behaviour, is key to unlocking value within family businesses. Practical ways of achieving this include encouraging open dialogue based on common goals and shared purpose; as well as creating simple, precise and well-structured internal slogans and messages that reflect your business’s vision, mission and values.

2. Establishing and strengthening connections

To rise above choppy business environments and difficult market conditions, consider taking a break to bond as a team. Schedule office retreats (when the COVID-19 situation has improved) to relax and engage in activities that will bring team members closer together. Getting to know your colleagues personally, and learning about how they prefer to communicate and interact, can go a long way to improving collaboration and creating trust. Using personality typing tools can also help to understand the diversity of behaviour within your business team.

3. Building trust catalysts across teams

Creating projects can bring together otherwise siloed functional teams to build mutual trust. More opportunities for collaboration amongst colleagues creates a culture where a sense of belonging is felt and trust is built across the company.

4. Improving communication processes and tools

As family businesses grow from one generation through the next, it becomes necessary to formalise communication channels7. Reviewing the existing norms of communication in a family business is helpful for determining what has or has not worked in the past. Using the company’s intranet to send internal newsletters is a great way to ensure your teams receive the information they need to carry out their work and involve themselves in company activities. Newsletters can also be used to celebrate successes, which helps build solidarity and a culture of belonging. Lastly, social media channels can be used to simultaneously build relationships with clients and work toward your business goals.

5. Leading by example

The leader of a family business has the opportunity to shape the culture of their company from the top down. One of the most important steps in doing so is sending out clear communications8. This can take the form of meeting regularly with employees about their needs at work; maintaining an open and welcoming attitude so employees feel comfortable voicing any thoughts or concerns; and being there to celebrate employees’ birthdays, anniversaries and important life events.

In family businesses, good communication is as important at the company level as it is at the family level. The challenge is discerning and working out a long term alignment between the two. This is where it can help to work with a partner like HSBC to facilitate dialogues between different family and non-family stakeholders. Businesses with inclusive corporate governance and communication plans designed with the family in mind stand a better chance of persevering across generations.

At HSBC Private Banking, we understand the challenge of navigating uncertainty and continuously changing circumstances. Our role is to walk alongside your family business, assisting with succession planning of your family and helping you manage and maintain continuity across generations. Above all, we want to see your family business thrive, now and into the future.

Please contact your Relationship Manager or Family Governance and Family Office specialists to discuss how we can assist you in achieving your business and family’s enduring legacy.

1https://businessfinancing.co.uk/the-oldest-company-in-almost-every-country/

2https://www.wealthx.com/about-us/press-news/2019/wealth-professional-wealth-managers-must-brace-multi-trillion-dollar-transfer/

3https://economictimes.indiatimes.com/familybusinessforum/insights/why-family-businesses-are-better-equipped-to-go-global/familybusinessforum_show/66860347.cms

4https://www.forbes.com/sites/aileron/2013/07/31/the-facts-of-family-business/#7d8c9b409884

5https://fortune.com/2020/02/11/s-and-p-500-stocks-microsoft-apple-amazon-google-facebook/

6https://hbr.org/2020/01/managing-the-trickiest-parts-of-a-family-businesses

7https://www.tharawat-magazine.com/family-business-winning-strategies/family-business-communication-art/

8https://daveschoenbeck.com/3-common-family-business-problems-can-solve/

Shaping a sustainable post-COVID-19 world

The ongoing COVID-19 pandemic has awakened many of us to a growing wave of urgency when it comes to the topic of sustainability.

“I think what has been happening in the world has triggered a deep reflection about how we can change the way we live for a better world. This has resonated with clients in our conversations. We want to support our clients by inspiring and helping them to make positive changes,” said Philip Kunz, Head of Global Private Banking for Southeast Asia at HSBC.

Unlocking the potential of family businesses

Like with many around the world, the challenges posed by the global pandemic have presented family businesses an opportunity to prioritise what is important for their cross-generational aspirations. It also underscores why family businesses cannot leave their succession planning to chance.

When Mr Jack Ma delivered his farewell speech to over 60,000 Alibaba employees, he reiterated his vision for Alibaba “to last for 102 years, stretching three centuries”, as reported by qz.com. Mr Ma decided not to simply pass the company on to the next generation or hand it off to professional managers but instead took upon a third path to nurture its own team, ensuring that the succession process is smooth with the help of system and culture. “That is why, I have been preparing for 10 years for today,” he said.

That Mr Ma had planned his departure from and passing on of Alibaba for a decade, with such a keen focus on generational succession, accentuates the need to discuss candidly the legacy of any family business.

No family business is the same, but all want to avoid the commonly cited curse of shirtsleeves to shirtsleeves in three generations. Turbulence can become a catalyst for family members to focus on discussions about the future. “We’ve had several meaningful conversations with our clients to address what is close to their hearts. Good communication is essential to successfully navigate the storm and protect the wealth and sustainability of family businesses,” said Mr Kunz.

Turning the spotlight on impact investing

Covid-19 has sparked market volatility comparable with the global financial crisis 12 years ago. However, some investments have fared better than others. Research has shown that actively managed ESG (environmental, social and governance) funds have outperformed during the Covid-19 fallout – a sign that concentrating on long-term goals reaps long-term sustainable gains.

The ongoing battle with Covid-19 has shifted the global mindset towards concerns about public health and the environment. It puts into perspective that investors have a crucial role to play, by maximising the impact of their portfolios, to mitigate the challenges of the current climate and beyond. This makes investing with an eye towards ESG credentials an interesting proposition. “In conversations with clients, they are indeed widening their scope when considering what type of investments they could undertake during this period,” says Mr Kunz.

The pandemic has also highlighted how companies that are synonymous with ESG have shown to be agile enough to adapt. The key is having a b governance structure in place – one that will establish a sustainable and resilient business model. This includes ensuring clear business continuity and succession plans are in place, in the event of unforeseen circumstances.

Additionally, companies that improve their sustainability standards over time often have higher or improving valuations. This correlation shows it makes good business sense for both companies and investors to start adopting sustainability standards into their strategy and portfolios.

Rising above a crisis

Sustainability is the silver – or green – lining of this crisis. When the threat of the Covid-19 reduces, questions will emerge over how resilient businesses and the economy really are to future shocks.

Covid-19 has extracted a devastating price, but it has also bought us another chance to pause and consider our options. One clear way to honour the extraordinary sacrifice of those who have put the common good ahead of their own interests, is to deliver a healthier, more resilient, and more sustainable future.

When asked about the role HSBC Private Banking plays in this endeavour, Mr Kunz was resolute, “We have the privilege to work with clients who have the influence and the means to make a positive change in the world. It is our role to harness our global connections and capabilities to illuminate opportunities for our clients – by presenting innovative ways that finance can play in shaping the transition to a sustainable future.”

This article was published in The Business Times Who’s Who in Private Banking supplement on 27 May 2020.

Entrepreneurship

Well-earned contentment: Why ethics plus profits equals true prosperity

A sense of purpose

Companies like Microsoft, which has just been voted most ethical company in a US survey2, have long understood the importance of purpose as a driver of long-term success in business. The firm has become a global giant by applying an entrepreneurial mindset to a real-world need: making computers both easier to use and less expensive to own.

Today, with everyone from Airbnb co-founder Brian Chesky to BlackRock CEO Larry Fink talking about purpose, the concept has gone mainstream. As Alibaba co-founder Jack Ma succinctly puts it: “If you want to be big, solve big problems”.

However, it isn’t only global corporations that can benefit from such an approach. As an individual, a purpose-driven mindset can be the perfect route to both personal fulfilment and personal wealth. At this level, Ma’s comment could translate as “if you want to be truly prosperous, focus on the big issue – defining and pursuing your purpose in life”. Some concrete examples will help demonstrate what we mean by this.

A structured approach: bringing sustainability to traditional industries and companies

In a corporate world that increasingly recognises the value of purpose, following a more traditional career path doesn’t preclude pursuing social or environmental impact.

Julia Bensily is a director at Singapore-based Prime Structures Engineering, a rising star in Asia’s construction industry. The firm specialises in building envelopes – those elements of the outer shell of a building that keep the interior dry, light, at a comfortable temperature and protected from external noise. Prime Structures’ projects include the landmark Marina Bay Sands Skypark and Changi Airport Terminal 3, both in Singapore, as well as Tawau Stadium in Malaysia, the Ministry of Finance building in Brunei3 and numerous other projects across Southeast Asia, including Indonesia and the Philippines.

Julia brings her ethical concerns to her role by encouraging the company’s focus on creating buildings that work with, rather than against, the environment, whether through maximising light and heat efficiency or in the sustainability of the building materials themselves.

“We started looking into how we could manufacture bricks in a different manner", says Julia. The result is an eco-friendly brick that is made out of rice husks as well as flay ash (the by-product of burning coal). "In the next 30 years I hope that the buildings we build are able not just to shield us from the external elements, but also help contribute in the renewal of it as well”.

Sourcing the future: supply chain transparency

Hong Kong-based merchandising-sourcing organisation William E. Connor & Associates Ltd, who has featured on the Ethisphere Institutes’ World Most Ethical Companies ranking for eight years running, holds integrity and complete transparency as a core value.

The business attributes its success to the high standards it applies to its supply chain, which are intended to prevent bribery and corruption. The company recently announced a partnership with Ethisphere and Omega Compliance to launch a new initiative that will promote ethics and integrity across Asia Pacific. The collaboration will host roundtable discussions and workshops into 2020. They will also capture key trends and best practices from leading companies across APAC that will be shared with the business community.

Rooted in ethics: building a business around sustainability

Josh Tetrick, co-founder and CEO of JUST Inc, embodies the attitude of a new breed of entrepreneurs who see no conflict between seeking to make the world a better place and working with global corporations in pursuit of the solution.

JUST specialises in researching and producing plant-based alternatives to traditional foods, including mayonnaise made from Canadian yellow peas and cookie dough made from sorghum. The company’s motivations are as much about developing less resource-heavy sources of food as about animal welfare.

Feeding the world’s growing population is a major challenge: the food sector currently accounts for around 22 per cent of total greenhouse gas emissions4, as well as being a major demand on land use. JUST’s products are directly aimed at addressing this issue. For example, the company claims their JUST Egg product uses 98 per cent less water, has a 93 per cent smaller carbon footprint and uses 86 per cent less land than conventional animal sources 5.

“I think the biggest mistake people make is that the big companies don't care,” says Josh. "We work with the biggest food manufacturers in the world because they want to grow more and they also want to solve problems.”

JUST’s latest project belies the vegan mindset by collaborating with Wagyu beef producer Toriyama to develop cultured beef from their prized cows6. The ethics of cultured meat may be up for debate, but the potential benefit to the planet is clear, as is the democratising effect of cheap, laboratory-grown beef, which offers the rich umami taste and exquisite marbling of prime Wagyu.

Watch Josh talk about how he uses technology to produce food that is healthier and more sustainable

A profitable portfolio: combining more and less profitable projects

Harper Reed is the data wizard widely credited with helping secure President Obama's re-election as CTO of his 2012 presidential campaign. He’s also a serial tech entrepreneur, a former Senior Director at PayPal, a board member of Keeper (a leading password manager application), a Trustee of Cornell College and a Senior Fellow at the USC Annenberg Innovation Lab, as well as being on the advisory board of the Royal United Services Institute (a defense and security think tank)7. In his spare time Harper likes to write on social issues in the tech field such as diversity and personal privacy.

Like Josh, Harper is passionate about facing down global challenges, in his case by embracing technology, data usage and fresh business models.

Listen to Harper on how he stays ahead of technology

"We typically think about disruption as a marketing term, but I think we're actually amidst some major disruption, whether it's migrant populations or deskilling and destabilisation of different workforces. That’s going to cause us a great deal of pain unless we come together and solve some of these problems,” he says.

While Josh, Harper and Julia have taken very different paths to success, they share one thing in common – a sense of purpose that is woven into their lives. Whether you want to make your own values the focus of a business venture, invest in sustainable companies, share your knowledge and experience as a board member or trustee, or simply make your company a better place to work, focusing on purpose will be incredibly rewarding.

We want to inspire our clients to make positive change in the world by taking a holistic approach to personal prosperity. To find out more about new ideas and new opportunities, speak to your Relationship Manager, who can guide you through the ways in which we can help.

1https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans

2https://justcapital.com/rankings/

3www.primestructures.com.sg

4Source: undp.org

5Source: ju.st

6https://medium.com/eatjust/a-new-tradition-721e5039de4

7harperreed.com

Tackling wastage

Wastage is one of the biggest sustainability challenges facing the fashion industry. That’s why Ronna Chao, Chair of Novetex Textiles, created The Billie System.

Smart Cities

Joined-up technologies have been hailed as a solution to urban problems. We examine how they impact an efficient and eco-friendly way of living today.

Cybersecurity

Falling victim to fraud

Fraudsters today are more sophisticated, more persistent and more convincing than ever. From romantic partners to solicitors, investment funds to schools, are you sure your payees are who they say they are?

Insights

A green reboot for the global economy

As we begin to turn the corner in the fight against COVID-19, one clear way to honour the extraordinary sacrifice of the millions who have put the common good ahead of their own interests is to deliver a healthier, more resilient, and more sustainable future. To do that, we need to reboot the economy in green mode.

The global recovery presents a huge challenge, but a historic opportunity. Temptation to focus efforts – and stimulus packages – on the quickest path back to growth is inevitable. But this is likely to result in significant short-term investment in high-carbon industries and hard-to-abate sectors, particularly in emerging markets. It could put the targets of the Paris Agreement far out of reach and leave us facing a more profoundly damaging climate crisis in future.

By instead using the trillions of dollars our governments have pledged for the recovery well, and accelerating the transition to the low-carbon economy, we can create the future we choose: one with more sustainable and inclusive long-term economic growth.

“Building resilience against future shocks must be a priority in recovery plans”

We have an opportunity to fund advances in environmental technology at scale, and to work to cover the large upfront costs needed to take renewable and low-carbon energy fully mainstream. This will also create greater resilience in the global economy, by reducing exposure to climate risk, which represents the greatest threat to the stability of the real economy. Building resilience against future shocks must be a priority in recovery plans.

The challenge I outline is not one to view from the sidelines. HSBC is choosing to use its scale, network and influence to play a leadership role in building more sustainable, and more inclusive, economic growth. Though we don’t yet have all the answers to plot this course, we know the only way we’ll make our greatest contribution is by saying: “We are in.”

We support the ETC’s seven priorities to embed the low-carbon transition into the economic recovery response. We too believe the most effective way to stimulate the green economy is to significantly reduce the cost of funding environmentally sustainable projects, and to focus investment in areas that will have the greatest impact on the low-carbon transition, such as renewable power systems, green infrastructure, and innovative low-carbon activities.

Crucially, we also recognise the importance of supporting higher-carbon sectors to make the transition to low-carbon without adding instability. So – aligned with the priorities outlined by the ETC – we will focus particular effort on supporting, and accelerating, the transition in harder-to-abate industries, such as automotive and fossil fuels.

We will work with governments and other banks to together identify the most viable opportunities to focus the recovery on the low-carbon transition, and offer subsidised funding to accelerate their success.

We’ll use our global trade and supply chain solutions to connect financing flows from all over the world to sustainable projects, and help build local financial centres as green financing hubs. In emerging markets, which face the most challenging transition, we will focus where the global benefit will be greatest. And we’ll help our business customers map the path to their own low-carbon transition, or identify sustainable investment opportunities at attractive rates.

We want individuals to see us as a facilitator of their own contributions to the transition too. We’ll work to support individual recovery, and continue to find new ways to help our customers grow their wealth and wellbeing while their money works to build a greener future.

COVID-19 has extracted a terrible price, but has bought us a chance to pause and consider our options. Our future social and economic welfare depends on a healthy environment, one that requires a significant level of investment, and a longer-term outlook. In banking, we consider risk and reward. It is clear to me that this investment offers the ultimate return: a cleaner, fairer, more prosperous and more sustainable future.

If we reboot into a green economy, we not only set the stage for renewed growth, we set the stage for sustained growth. We are in.

Cloudy now, brighter later

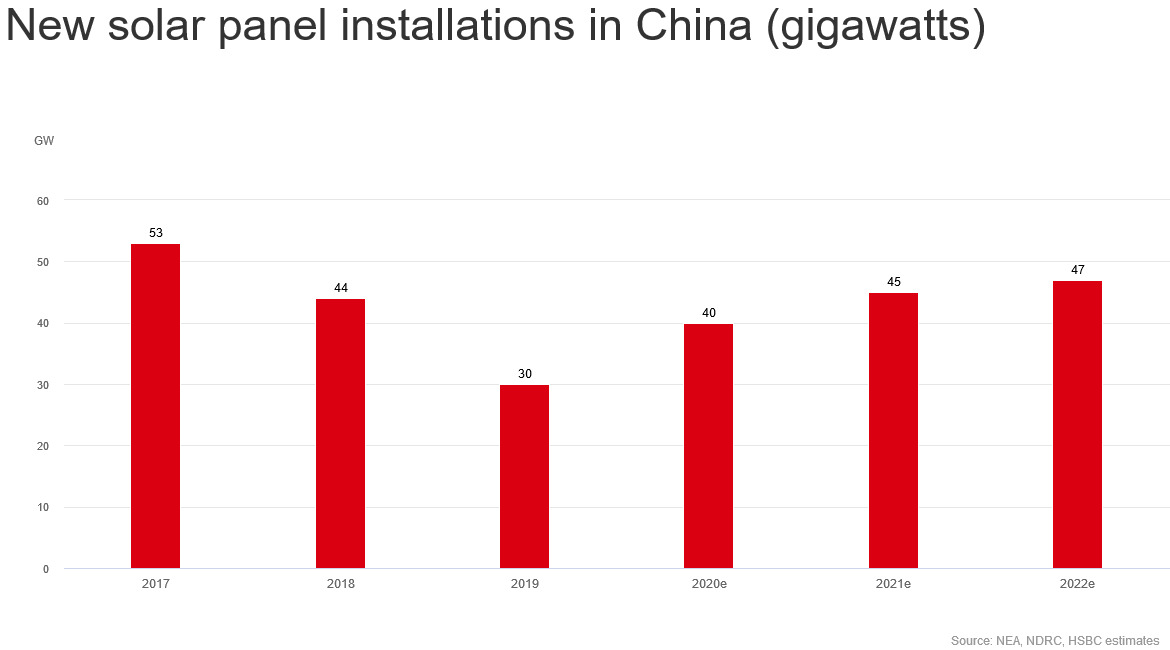

The global solar panel installation boom is under threat from the disruption of the COVID-19 pandemic. Growth is set to slow to only 4 per cent in 2020, potentially stalling the pace of the low-carbon transition. However, despite this short-term shock the market is expected to remain resilient and recover from 2021 onwards.

However, in some places activity could bounce back quickly. In China, the world’s largest solar market by some distance, installation is expected to recover bly in the second half of this year, finishing 2020 with 33 per cent growth year-on-year. This implies an addition of 40 gigawatts (GW) of capacity, against an increase of 30GW last year. A further 45GW of capacity is expected in 2021.

“In some places activity could bounce back quickly”

Recovery will be slower in other markets. In Europe, much of the solar installation activity is in the residential consumer space. Mobility restrictions are currently limiting access to roof space and the downturn in the economy is forcing consumers to grapple with financial constraints. Low residential appetite could continue through 2020 and 2021, depending on the severity of the recession.

In the US construction quotation activity and permit approvals have largely continued, albeit at lower levels. Following the disappointment that renewables were not included in the USD2 trillion stimulus package in March, expectations in the US are rising for a cash-in-lieu-of-tax equity provision being included in a potential follow-on stimulus bill currently being discussed. Without such measures, renewables activity could come under further pressure.

In the longer-term, though, the positive outlook is undimmed: increasingly low costs mean solar should cement its place as the core renewable power generation technology to 2030. By 2022, cumulative solar capacity in China alone should reach 336GW, steady growth from the 204GW installed by the end of 2019.

After the pandemic

The COVID-19 pandemic could do permanent damage to the global economy, dashing hopes for a quick recovery and encouraging governments to ‘onshore’ manufacturing in critical sectors.

Governments the world over are attempting to build a bridge over the economic and financial crevasse created by COVID-19 to enable many businesses to pick up where they left off before lockdown. Those countries with deep and liquid domestic capital markets and with credible institutions are likely to be best placed to do this.

Some nations – mostly in the emerging world – face a particular struggle to recover. For instance, the level of economic activity in Brazil and India may end up more than 4 per cent lower by 2021 relative to HSBC Global Research’s end-2019 forecasts, double the shortfall we expect to see in countries like the UK and China.

Bridge-building will be more effective within nations than across nations. As China is discovering, ending a local lockdown does not imply that a country can re-engage with a prosperous and dynamic world economy: whatever policymakers achieve domestically, they cannot fully offset the impact on a country’s exports (and, hence, its overall GDP) of collapsing demand elsewhere. We may see more ‘social distancing’ between countries as they emerge from lockdown at different times.

The cost of bridge-building will be most visible in the form of much higher levels of government debt, akin to increases more typically seen during wartime. At this stage, the consequences of these hefty debt increases are unclear: the better the bridge, the bigger the economic rebound and the more digestible is the debt. Wartime experience suggests, however, that significant scarring could lead to either higher inflation, more austerity or, for countries in desperate financial circumstances, capital controls or default.

Technology could potentially come to the rescue. Just as the post-war technology boom boosted US economic recovery in the 1950s, the war against COVID-19 will also lead to significant technological changes that, in time, will trigger major shifts in how societies operate. Not all of these shifts, however, may be positive for all.

One obvious change is the likely proliferation of home working, an outcome that may significantly reduce time spent on travelling to places of work. In turn, this might lead to a reduction in office space and an increased supply of property for residential purposes. A second, related, change is a likely proliferation of ‘virtual’ meetings and ‘virtual’ conferences: audio-visual quality will doubtless improve at a rapid rate in coming quarters and, as it does so, the need for physical meetings will decline. This will both reduce costs for companies and limit the business risk associated with heightened restrictions on the cross-border movement of people. In both cases, there is likely to be a significant and lasting climate ‘dividend’.

“Technology could potentially come to the rescue”

A third change – already happening before the COVID-19 lockdowns – is the use of technology to shorten global supply chains and encourage ‘reshoring’, suggesting a growing income gap between already-industrialised economies and those in danger of being left behind.

This process may be accentuated through the economic consequences of COVID-19. Governments may increase their preparedness against other rare but high-impact risks, placing a much wider range of economic activities under the ‘strategic industries’ banner. Global supply chains are likely to be attenuated, with home bias becoming a much bigger influence, marking a part-reversal of the efficiencies gained over the past half-century.