Feature Story

Intelligent investing in the new world

Digital transformation is disrupting every sector, creating new investment opportunities. But to spot them, you need to put the technology into context.

The ESG effect: Why investing in line with your values will increase because of COVID-19

Sophie HAAS, CFA, Head of Sustainable Product Offering at HSBC Private Banking discusses ESG at times of crisis and why now, more than ever, it’s an economic and societal necessity which should be front of mind.

But what is ESG and why should it matter now, during the COVID-19 pandemic?

Sophie, what's the clearest description of ESG?

ESG is the integration of environmental, social and governance factors in the investment decision-making process, as they have the potential to be financially material. We look at ESG from both a risk and an opportunity perspective.

Sustainable investment is about allocating capital to economies to help them thrive. That capital is directly linked to financial returns, in a way that's beneficial to the environment and society.

When we think about the bigger picture, we look at the whole spectrum of capital, from responsible to impact investments, depending on the level of financial returns and environmental or social impact the client is keen to make through their investment portfolio. Sustainable investing is everything between traditional finance and philanthropy. Clients can choose from a range of investment methods from avoiding harm to the environment and society, all the way through to actively contributing to finding solutions to environmental and social problems.

What changes have you seen when discussing ESG with clients?

ESG integration had in the past gained more interest amongst institutional investors, however with more global headlines around climate change, poor corporate behaviour and issues of labour rights in supply chains, more investors are now aware of these issues and want to understand how their investments can drive change.

Whereas in the past Private Banking clients were more focused on ethical exclusions from their investments, we are now seeing that clients wish to invest in a way that is respectful of our environment and society.

In particular, younger investors such as our NextGen clients expect to see more from their investments than just financial returns. They want to do something purposeful with their investments, understanding that they can shape the society and environment we live in. We've seen a lot of reports in the media about students lobbying their universities to divest their endowments from fossil fuels, for example. We want to offer investment solutions for their personal wealth that reflect their sense of purpose in a meaningful way. Their influence is being felt across the industry from family offices, through lobbying foundations, corporate boards, and endowments, to raising awareness and changing investment behaviours across generations.

Sustainable investing plays a role in long-term value creation and preservation. That's why it is so important for Private Banking clients.

As far as the ESG acronym is concerned, where do you see the most potential for interest: environmentalism, society, or governance?

In the past we have seen more interest in environmental issues. The E of ESG is easier to understand and measure and we've seen that reflected more in the media than the S and the G. Social aspects were perhaps harder to define or grasp for investors.

That being said, the COVID-19 pandemic has also brought to light Social Issues and the way the most vulnerable populations have been affected. Many employers have been offering health and job protection to employees, while others have behaved disappointingly in the eyes of many, furloughing their employees when some had the cash reserves to keep them on.

ESG integration is the simple idea that companies which succeed long term, and deliver shareholder returns, are those which create value for all stakeholders - employees, customers, suppliers, the environment and wider society1.

We need to place more emphasis on Social issues. For instance, are workers' rights being respected? Is the lack of health benefits, paid holidays and sick leave putting employees in harm's way? What policies should companies have to protect their workers in this challenging environment and have existing ones been updated? Asking these questions makes sense from a long term return and well-being perspective.

There have been criticisms that too much ESG investing is tilted towards large cap equities because publicly quoted firms disclose more data and are easier to analyse… What are the drawbacks to that for investors coming in, and how do you see it evolving?

On one hand, large cap companies have more resources to put towards ESG disclosure and transparency. On the other, this means they are under more scrutiny in the public eye and under greater pressure from activist shareholders to deliver change.

Public companies are under more scrutiny because their footprint is bigger and they tend to be more in the spotlight: there are more analysts covering them, they have more shareholders, they are better known by the public and are more likely to be the target of NGOs, lobbies and corporate engagement teams.

For example, Climate Action 100+ is an investor initiative targeting the 100 largest corporate greenhouse gas emitters, because to tackle climate change and reduce drastically our Greenhouse Gas emissions, we need to start with the largest emitters.

With more firms going private, what tools exist to analyse such firms from an ESG point of view? And from your vantage point what can public markets learn from private markets on how to screen companies' ESG practices?

We already know that transparency and disclosure is a challenge when integrating ESG into fixed income for instance. Some private companies issuing debt are less transparent than publically listed ones, often because they are simply not required to do so.

For private markets, I would focus rather on impact than ESG integration. Private markets have more flexibility to have impact targets as part of what investors expect from them and they also require new capital. Different objectives can be set more easily beyond maximising shareholder returns. For impact investments to have additionality, meaning bringing new capital to help solve social and environmental challenges, private markets are the most effective option. But it is important to be selective in that space.

Does human bias and behaviour influence ESG investment choices, and to what degree?

Sustainable investing is somewhat subjective because there are as many clients as there are sustainability preferences. This is particularly true regarding negative screening and ethical investing. While some clients want to exclude alcohol or tobacco, others prefer to omit fossil fuels or nuclear energy. These preferences have nothing to do with optimising efficiency by maximising their risk/return profile. You could say, sustainable investing is to a large extent about embedding your values into your investment decisions so, yes, human behaviour does play a large part in sustainable investing.

There is currently a lot of volatility and fear in markets – how can ESG help frame investment and poise through such a period over the medium term?

We believe that ESG will not only survive the bear market, but it will thrive even more so, once we recover from the turmoil. Today's market shows that too many companies and investors fail to price in environmental and social issues, which can lead to careless corporate behaviour towards stakeholders. Since the beginning of the COVID-19 pandemic, our ESG analysts have established that not only have Climate tilted and ESG indices outperformed their broader market peers, but long-term data is even more supportive of ESG integration2.

COVID-19 has brought disruptions to communities and societies around the world – it's highlighted how the most vulnerable are being treated. This crisis will hopefully put our wellbeing and the environment front and centre of our economic system and ESG integration is the most useful tool for investors to achieve that. Sustainable investing plays a role in long-term value creation and preservation, which explains why it makes sense morally and financially. Therefore, we strongly believe ESG will not only be resilient in the current market environment, it will also become more prevalent.

1 Adapted from a quote from HSBC Global Research, ESG matters: Climate and ESG outperforming during COVID-19, 25th March 2020

2 https://www.research.hsbc.com/R/10/mHfHwPMdWtt6

Wealth Planning

Family offices need to stay cyber-vigilant in this fast-changing world

The current climate has caused many of us to pause and reflect. How will COVID-19 change our attitudes towards starting productive family conversations, and what help or advice is available to guide these important decisions?

Potential pay-outs for scammers can be achieved by obtaining sensitive data about investments, or through ransomware attacks, where cyber criminals hold sensitive information and attempt to blackmail individuals or family offices. With valuable reputations often at stake, family office cybersecurity practices need special care.

New cyber risks

Primary dangers for family offices include employees who are now working from home, using potentially insecure wi-fi networks or devices with weak passwords. Additionally, organisations may be using new programmes and online systems to file-share or video conference, without the knowledge of how to keep data safe, or reduce vulnerability to attacks.

Much cyber fraud depends on an individual clicking a malicious link that allows the criminals access to information or systems. As such, fraudsters are taking advantage of legitimate fears around health and finances to help sell their scams and encourage people to click links or enter personal details. Other have posed as business partners updating clients on new banking processes due to the pandemic.

Hacks and scams

There are two main lines of attack for cyber criminals: hacks and scams. A hack tries to gain access to a protected system in order to control or manipulate it or steal sensitive data. These are the more technologically advanced cyber-attacks.

High profile cases, such as the recent ransomware attack on Grubman Shire Meiselas and Sacks, a New York law firm with a roster of A-list clients, shows the vulnerability of data. A USD21 million ransom demand quickly doubled in value as the criminals threatened to leak sensitive data about the firm's celebrity clients.1

Scams tend to use information to try to trick data or cash out of people and companies. Social engineering, meanwhile, gathers data on individuals or firms to set convincing traps and deceive individuals or companies into handing over information or even paying money into their accounts.

The right tools for the job

A robust cybersecurity system has to employ tried, tested and verified processes and software, and then teach all employees how to use them effectively. In response to a growing level of cyber-criminal activity, the FBI has created guidance on how to prepare, protect and respond to threats, including ransomware.2 Whether at home or in the office, there are key tools and procedures that can help:

|

Keep all computer software and devices updated. |

|

Use secure connections to transmit all information. |

|

Communicate important financial information such as sort codes and account numbers by phone. |

|

Consider using an encrypted email system or a password manager. Use two-step verification whenever it's available. |

|

Make sure any smart devices are password protected and also have two-step verification enabled. |

There are a number of tactics that family offices and their clients can introduce to support the security systems in place to protect them. The first step is to be prepared:

|

Staff should have ongoing training on new and existing threats as well as how to prevent and detect them. |

|

Passwords should be strong and backed up by multifactor authentication. Firms should also employ administrator rights to ensure that data is only available to people who need to access it. |

|

All family offices should test their IT environment for weaknesses and use in-house or outsourced monitoring to detect any unusual behaviour. A security specialist can be an extremely useful advisor. |

|

Back-up to a secure, independent network. In the event that data is held to ransom with the threat of deletion or corruption or denial of service, your data can be restored and used to maintain operations. |

Antivirus and firewalls will offer a degree of protection, but not against all malicious intentions. To combat fraud and particularly sophisticated social engineering, there has to be a security process in place.

|

Thoroughly scrutinise investment opportunities, offers of tax rebates, and official-looking emails that talk about government relief programmes. Where possible, try not to follow links in emails. |

|

Family offices should be sure that they have up-to-date contact information for all clients. Consider using a password for future checks or updates to verify authenticity. |

|

Always independently verify bank account details. For example, directly call the client to verify an emailed change, using the number on file, not the number in the email. If in doubt, ask to transfer or be transferred a nominal amount – less than a dollar – to ensure it reaches the right account. |

1 https://www.cpomagazine.com/cyber-security/ransomware-attack-hits-one-public-figure-after-another/

2 https://www.fbi.gov/file-repository/ransomware-prevention-and-response-for-cisos.pdf/view

Entrepreneurship

Purpose over profit – The future of entrepreneurialism in the face of COVID

The world continues to watch as the next generation of entrepreneurs use their businesses as vehicles for positive change, integrating purpose and impact, to build back better. What are the changing attitudes of the next generation of entrepreneurs?

Let's look at environmental impact. In France, we've seeing entrepreneurs embracing a "home-grown and traceable approach" such as organic products in cosmetics. In fashion, we're seeing businesses such as Le Slip Français focus on local production and home-grown supply chains with low carbon impact. The crisis has made founders stop and evaluate their supply chain, and some more established businesses are seeing the benefit and impact of their value proposition in a fresh light.

For example, French food waste start-up PHENIX are connecting supermarket chains with non-profits to create a circular economy, the impact of which is more tangible today than ever before. However, the Covid-19 crisis has highlighted the need to not only focus on the 'E' or environmental factors of ESG, which has long been the focal point of the acronym. It has also cast a light onto the 'S' or social aspects.

When we look at organisational infrastructure we can see that digital communication is set to change for the long-term future with employees and users, and a real focus on transparency and wellbeing. Edtech companies like Klassroom are connecting teachers and parents using apps in order to develop a sense of community whilst schools are in lockdown, simplifying the communication process in doing so.

Investors look to impact opportunities to fuel returns

It's highly likely that the pandemic will accelerate the movement towards investing in businesses focusing on impact and purpose. In greater numbers, investors are responding by making direct 'angel' investments through to taking out private equity. We are also seeing a growth in funds, with some entrepreneurs developing their own investment funds and structures, known as 'startup studios' or accelerators. Despite the huge disruption that Covid-19 has brought, as the dust slowly settles, we're seeing that good ideas are managing to raise capital, particularly in the digital, cyber-security and technology spaces.

In recent months, we've watched a Fintech established to advance touch payment systems raise EUR40 million, while EUR110 million was raised by French recycled mobile phone company BackMarket to develop a circular economy for digital devices. ALAN, a new, mature insurtech company has also recently raised EUR50 million to digitise and simplify health insurance services and the user experience for customers. As a strategic partner of entrepreneurs, we know that we have a key role to play.

For mature business ventures, with high cash reserves and a good degree of flexibility, entrepreneurs will have to react not only in terms of the ways in which they work to adapt to the coronavirus crisis, but also pivot to meet the change in consumer habits by offering products and services that meet with their higher expectations in terms of delivering impact.

The business world continues to watch as the next generation of entrepreneurs thinks at pace about integrating purpose and impact into a post Covid-19 world, using their businesses as a vehicle to deliver positive impact for their societies. Purpose should always drive a business vision especially in times of crisis. Making sure it categorically comes first is a sure indication of the benevolence and driven mindset of the entrepreneurial community.

Note: this article is a shortened version of an opinion piece entitled "How the coronavirus crisis will drive the next generation of entrepreneurs towards impact" originally published in Private Banker International.

Cybersecurity

Cybersecurity in the new normal

Fraudsters are taking advantage of the sudden global increase in remote workers and weak security measures. What strategies can you put in place to avoid becoming a victim?

Insights

Navigating a crisis and emerging resilient

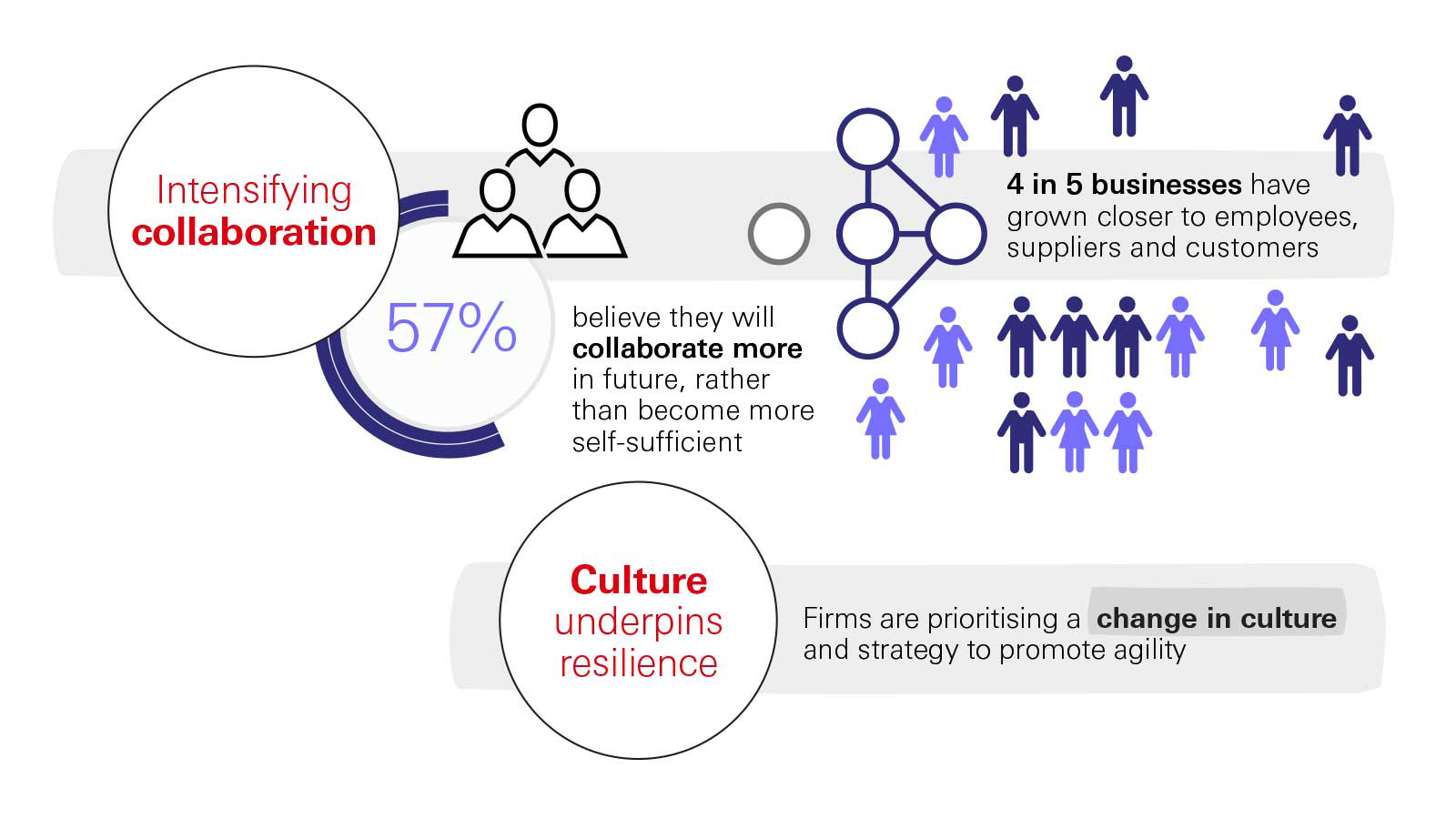

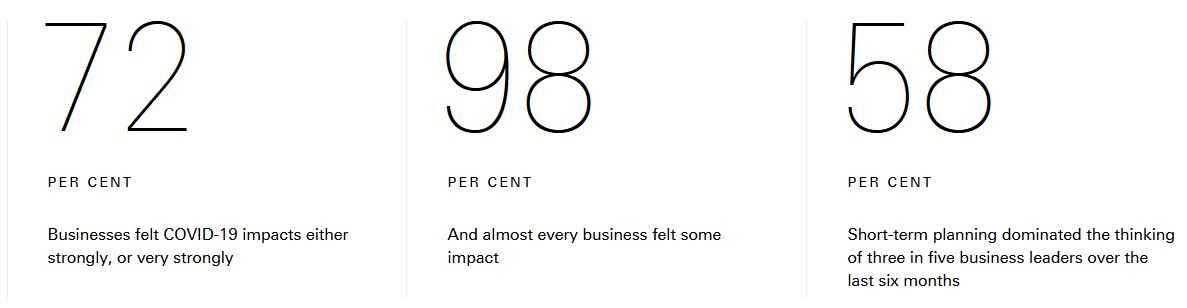

Companies around the world are making significant changes to how they operate, after many found their contingency plans couldn’t cope with COVID-19. That’s according to HSBC Commercial Banking’s new report which draws from a survey of more than 2,600 companies in 14 countries and territories.

It shows that many firms lacked proper planning in key areas such as technology, finance and sustainability prior to the crisis, with nearly half saying they could have done more to prepare for the challenges posed by the pandemic.

Over the previous two years:

|

Fewer than three in five companies (57 per cent) surveyed had prioritised investment in technology to enable remote working |

|

Only 44 per cent had prioritised strengthening their financial position, making cash flow disruption during the crisis more challenging |

Agility and resilience

Barry O’Byrne, Chief Executive, Global Commercial Banking, HSBC, said: “Businesses aren’t waiting to be told how to build back better, they’re starting now.

“The huge economic damage and human tragedy caused by COVID-19 have accelerated transformation plans and have brought relationship interdependencies to the forefront of leaders’ thinking.

“Since history shows that some businesses will fail coming out of a downturn, it’s vital that leaders push ahead with efforts to make their enterprises more agile and more resilient.”

The businesses surveyed – across the Americas, Asia-Pacific, Europe and the Middle East – are becoming more agile in their staffing and office arrangements, with a greater focus on technology and sustainability.

A total of 38 per cent are rethinking their physical footprint, while 69 per cent believe flexible working will become standard practice and 57 per cent say virtual meetings are here to stay.

How collaboration and a change in culture are helping companies to prosper

Some 91 per cent aim to make their business more sustainable, while 27 per cent intend to make their supply chains more environmentally friendly over the next two years.

Surviving future shocks

Many of the companies surveyed are taking action to increase their supply chain security and protect themselves against potential disruption in the future. They are:

|

Identifying and securing critical suppliers (67 per cent) |

|

Reviewing their suppliers’ ability to withstand future shocks (31 per cent) |

|

Diversifying their supply chain by working with more partners (29 per cent) |

Nonetheless, businesses see a number of challenges ahead, with 31 per cent struggling to maintain sufficient cash flow and 33 per cent seeing poor employee morale as a barrier to building resilience.

Access the full report on the Commercial Banking website.

Source: HSBC

Note: The Navigator survey is conducted on behalf of HSBC by Kantar. It is compiled from responses by decision-makers at 2,604 businesses, ranging from small and mid-market firms to large corporations, across a broad range of sectors. The respondents hold influence over their company’s strategic direction and represent a broad range of roles: including c-suite, finance, procurement, supply chain, sales and marketing. A total of 14 markets were surveyed between 28 April and 12 May 2020.

|

Americas: Canada, Mexico, USA |

|

Asia Pacific: Australia, Hong Kong, India, Indonesia, Mainland China, Malaysia, Singapore |

|

Europe: France, Germany, UK |

|

MENA: UAE |

HSBC wins sustainable finance recognition

HSBC’s expertise in sustainable finance has been underlined as it took home three major prizes at Euromoney’s annual regional awards. It was named Best Bank for Sustainable Finance for the Asia, Middle East and Western Europe regions in the prestigious awards organised by the global business and finance publication.

Daniel Klier, HSBC’s Global Head of Sustainable Finance, said: “Winning this award in three regions is testament to our leadership in sustainable finance. I expect to see an acceleration of climate-aligned financing as the world recovers from COVID-19. We are in a great position to support a more sustainable and resilient recovery.”

The award judges said: “HSBC is the go-to bank for the financing of renewables and for those looking to transition to a less carbon-intensive future. It also pushes scalable innovation in sustainability in a way that perhaps no other bank does.”

In total HSBC won 12 awards, including two for the way we led the banking industry's response to the COVID-19 pandemic:

Asia

|

Best Bank for Financing |

|

Best Bank for Sustainable Finance |

|

Hong Kong’s Best Bank |

|

Hong Kong’s Best Investment Bank |

|

Excellence in Leadership (for our COVID-19 response) |

|

Best Bank for Sustainable Finance |

|

Best Investment Bank |

|

Best Bank for Transaction Services |

|

Best Bank for Sustainable Finance |

|

Excellence in Leadership (for our COVID-19 response) |

|

Kuwait’s Best Investment Bank |

|

Oman’s Best Investment Bank |