Purpose and passion often go hand in hand. Find out more about Entrepreneurs David Yeung, CEO of Green Monday, and Jean Moreau, Co-Founder of Phenix, about the impact of purpose on their business success and why it's very much their north star.

Yet for these entrepreneurs, making an impact isn't just about the feel-good factor. It's intrinsic to why they are successful.

As part of a series of articles sharing stories from entrepreneurs across the world, we look at the examples of two genuine pioneers of purpose, David Yeung, CEO of the global environmental movement Green Monday; and Jean Moreau, co-founder of Phenix, a food waste reduction venture.

Both these leaders realised their own values were aligned to an emerging social consciousness among their customers that was not being addressed by traditional business models.

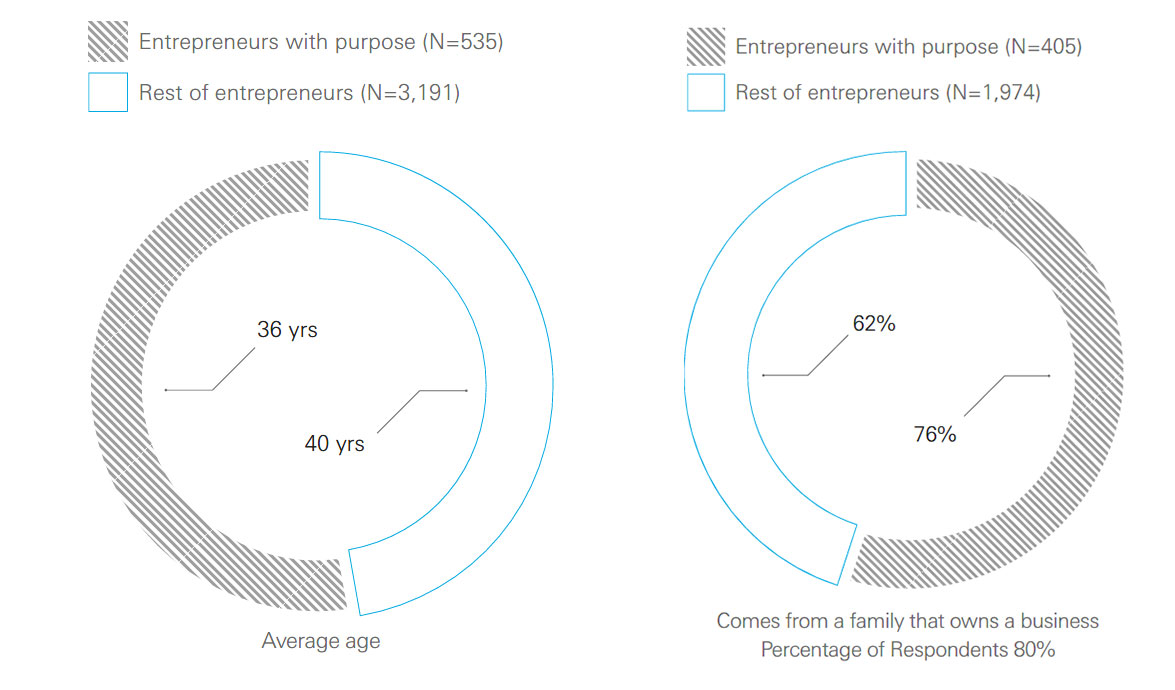

Purpose is the north star for a growing number of entrepreneursHSBC's proprietary Essence of Enterprise research indicates Jean and David may be part of a wider trend as purpose-led entrepreneurship takes off across the world [Figure 1].

Figure 1: Purpose-led entrepreneurs are often young and from a family business backgroundQ: How old are you? / Do you come from a family that owns a business? [Yes]

'Entrepreneurs with purpose' said they became an entrepreneur 'to have a positive economic impact' or 'to have a positive impact in their community'.

Source: HSBC, Essence of Enterprise

Hailing from diverse backgrounds, what these pioneers really have in common is a shared mindset. They are bold and unconventional in their thinking, which means they sometimes see new solutions to longstanding challenges. Or, as David puts it, "When everyone else goes left, we go right."

Sometimes they are even able to shift behaviours by awakening a consciousness in consumers that wasn't there before. David, for instance, had been a vegetarian for more than a decade before he decided to start Green Monday in 2012 as a platform to enable the transition to plant-based nutrition. At the time, he felt there was "zero awareness in Asia" of the impact of excessive meat consumption on the environment.

David knew that not all consumers would be willing or able to embrace plant-based nutrition, so instead, followers of the Green Monday movement adopt a vegan diet on the first day of each week.

Jean alludes to similar motivations compelling him to set up his food waste reduction venture Phenix. The business finds a second life for food across Europe by connecting supermarkets (which have high volumes of unsold and expired products) with charities, which are facing surging food demand.

He explains: "After working in banking, I had a crisis of conscience. I wanted my energy and entrepreneurial drive to serve a more noble cause, one that would have either a social or environmental purpose. Both came together in Phenix."

A common cause brings together an engaged community, working towards the same goalPurpose and passion often go hand in hand, and entrepreneurs can feel the benefits in the form of a community of customers, partners and investors that are all bought into their vision.

Particularly in the foundational years of the business, an organic and ongoing communication between founders and customers can be a powerful catalyst for growth. Engaged customers can act as product testers and advocates, for example; while impact-seeking investors are thinking long-term.

Aurélien Drain, Head of Business Development for HSBC Private Banking, France notes: "The network effect is important. With a strong community of clients, entrepreneurs can scale up, and in these early days investors and founders are not necessarily looking for profit straight away. It's more about the number of recommendations and connections you can create with the same client, resulting in repeat business."

Community can take different formats. Green Monday, for example, forms deep partnerships with other businesses that share its purpose. David explains: "If we want to shift the world to a more plant-based diet, no company can do it alone as it can only serve a small proportion of the population. Green Ventures, the impact investment arm of our business, is creating an alliance. We were early investors in Beyond Meat and we invest in other food technology companies that share our vision and goal."

Purpose can drive the product innovation needed to accelerate changeFor many purpose-led entrepreneurs, advocacy is not enough: they want to develop solutions to the challenges they see, all the while working tirelessly to raise awareness of their mission.

In its inception, Phenix wanted to reduce food waste at the consumer level in fridges but found the economic model problematic, so settled on a business-to-business approach instead. Recently, it returned to its original mission by launching a mobile app where consumers can buy unsold food items at a discount.

Impact is also accelerated through the set-up of Green Monday. It has a foundation focussed on education and outreach; Green Common and Omni Foods innovate new products, including meat and dairy alternatives; and Green Ventures makes impact investments in synergistic businesses.

Jean concludes: "We are showing that there is a middle path between traditional capitalism and the world of non-profit. We have tried to come up with a new model without sacrificing growth or ambition, while still having a significant impact."

Wealth, Vision and Purpose: Philanthropy has evolved. Today's entrepreneurs and investors are increasingly eager to be change makers, using their wealth to make a positive impact on society.

Among the many trends in impact, we continue to see the younger generation of entrepreneurs and investors use their businesses and personal wealth to make a positive impact on society. These entrepreneurs are choosing to tackle some of the world's biggest challenges and, as a result, tend to focus their initiatives on one or two key areas, such as education, the environment or healthcare.

"Our clients are global citizens and embrace globalisation in how they give,' says Dorothy Chan, Head of Philanthropy Advisory and Charitable Services at HSBC Private Banking in Hong Kong. "There is a lot of emphasis on education, for example, as many believe that that's an area where effects can be amplified."

Because these topics can be both global and local in scale, many become 'philanthropic entrepreneurs', devoting their energies while in the prime of their lives to set up and direct their charities or foundations alongside their main businesses.

Carly Doshi, Head of Philanthropy, Family Governance & Family Office Advisory at HSBC Private Banking in the US has witnessed this inter-generational shift in mindset. "Historically, investors would consider the immediate purpose of an investment: pure financial returns or pure philanthropic motivations. Today, we see many socially-minded investors apply a more sophisticated analysis – blending investment return goals with social impact considerations – to arrive at a more holistic spectrum, rather than a bucketed approach. This is particularly true among Silicon Valley entrepreneurs, who are generally comfortable challenging accepted norms and applying strategic problem-solving to all of their work, including their philanthropy."

A sense of urgency is leading to innovative new approachesUnlike previous generations, the desire to see results achieved in their lifetime has led to an evolution in the type of impact-focused organisations being set up. The most noticeable is the move from foundations set up in perpetuity, which spend only the income or a limited proportion of capital each year, to 'time-limited' or 'spend-down' foundations. An example of the latter type is the Bill & Melinda Gates Foundation, which intends to wind down its resources within a set timeframe.

"Clients are increasingly focusing on the purpose of their wealth," says Sophie Ward, Head of Charities and Education at HSBC Private Banking in the UK. "This runs through both the way it is invested and how it is disbursed to philanthropic causes."

"Today, individuals want to target their capital towards specific causes, like climate change or to support a specific UN Sustainable Development Goal, which is currently facing a USD2.5 trillion annual financing gap. If you think about it, 100 years from now will be too late, so the number of years to make a difference is limited and clients understand that it requires serious investment across all of their financial assets."

Foundations with a perpetuity timeline still comprise approximately 70 per cent of all foundations. However, of newly-established foundations, almost half are time-limited. Ten years ago, that figure was 20 per cent.

Among the ultra-wealthy, there is also a rise in the number of people making a promise to dedicate at least half of their wealth to charitable causes during their lifetime or in their wills via The Giving Pledge.

Today, there are over 200 signatories from 23 countries pledging over USD500 billion to a wide range of causes.

In Dorothy's experience, the sense of urgency felt globally is helping to mobilise resources: "We're hearing more clients say they want to spend down their funds. They've been around for some time and are eager to see change. And in the greater scheme of things, they don't feel the need to leave a legacy. They don't see themselves as a Rockefeller or a Ford, so want to put their resources towards good causes now."

The most impactful ventures are collaborating to solve challengesEntrepreneurs with a passion often want to maintain close involvement with the initiative they're funding and its strategy. To amplify impact, an increasing number choose to pool resources and collaborate with like-minded private investors, either through specialised multi-family offices or venture capital (VC) arms, like CREO Syndicate or Breakthrough Energy Ventures.

The sentiment is that entrepreneurs – who have the conviction and vision to create a thriving business – can effectively use those same skills to transform social missions with previously unquantifiable metrics into tangible contributions to society.

"We have clients who have a business, foundation and a venture capital fund, so they're using all tools at their disposal to bring about change," says Dorothy. "Models like Breakthrough Ventures is how multi-family offices tend to operate. VCs are extensions for philanthropists, and foundations and their investment arms complement each other."

While there is no definitive blueprint for change, philanthropic entrepreneurs are using the full spectrum of resources available to build a better future. By aligning investments around social values and developing a roadmap for how progress can be measured, this new generation of leaders is expanding the capacity in which change can be delivered – and accelerating its timeframe.

Wealth Planning

Women & Wealth: Mastering your plan and doing it all

Some studies anticipate that over the next 20 years, women will come to control more than half of the world’s wealth. But the fact remains that the wealth management industry does not successfully serve women.

Women are quickly becoming the most important consumers of wealth management services. With the coming USD68 trillion in wealth transfers1 over the next 20 years, it’s anticipated that women will soon control more than half of the word’s wealth.

But the fact remains that the wealth management industry does not successfully serve women: within a year of their spouse’s death, nearly two-thirds of women change financial advisers2.

‘Women and Wealth: Mastering your plan and doing it’ acknowledges these complexities and seeks to help women understand some of the key principles of managing wealth. Added to this, though 500 companies, becoming Heads of State, and founding some of the world’s most important companies, they nevertheless face specific financial challenges:

|

The wealth gap between women and men endures, with women having less access to private capital, being more likely to take time off from their careers, and in general, earning less money than men over the course of their lives. |

|

Women tend to outlive men – so not only do they need their wealth to last longer, but also, they are often in the position to make decisions around their family’s wealth over the long term. |

And let’s face it- women lead truly busy lives, running their careers, in many instances acting as primary caregivers for their children, family and household, taking care of aging parents of often, doing all of this at the same time.

With this in mind, listen to a dynamic panel discussion focusing on the unique concerns and considerations faced by women as they take on wealth management, strategic estate planning, investing, and planning for the future.

1CNBC, What the coming 468 trillion Great Wealth Transfer means for finance advisors, October 20192CNBC, for some widows, breaking up with an advisor is easy to do, October 2014

Trust, Innovation and Sustainability: In conversation with the de Caroto Family

Only one-third of all family-owned businesses survive into their second generation. Find out how the Rivera Winery owned by the de Coarto family continues to flourish since late 1940s, while the family remains true to the founder’s vision.

Rivera soon gained widespread recognition, and became the benchmark of Puglia quality wine production. When second-generation family member Carlo de Corato came onboard in the early 1980s, he introduced innovations in both vineyards and winemaking, enabling Rivera to sustain its reputation and success. As the wine industry became increasingly competitive, the de Corato family remained focused on its business goals and constantly adapted with the times, yet still retaining its tradition.

So, how has the Rivera family business remained authentic across 3 generations? The answer lies in their appreciation of cultural roots and family history. Sebastiano de Corato, son of Carlo and third generation family member, spoke fondly of how he first learned of the family business’s legacy, “I spent long afternoons listening to my grandfather’s Rivera stories on how he designed the first label; called the first professional winemaker to the winery, how he met the then President of Italy and have him drink his wine…over and over again.” Sebastiano’s heightened awareness of the family’s legacy, from humble beginnings to achieving global fame, enabled him to firmly understand the business’s ambitions in an extremely intimate manner.

The strength of a family business is measured by its ability to adapt through changes and swiftly overcome conflicts. Carlo explained how the family navigated market changes, “always by innovating and investing in new projects, either productive or commercial, with a long term view.” This mindset has helped them to tide through several setbacks such as this pandemic, and sometimes missed opportunities.

When dealing with disagreements, Carlo emphasised that they respectfully discuss and make strategic decisions like any Italian family, “over lunch with a glass of wine.” This deceptively simple ethos allowed the de Corato family to manage generational differences in the workplace with ease. Granted, this strategy requires significant familial trust, open communication and an iron-clad belief in the next generation’s judgement. The de Corato family’s approach, while unconventional, proves the typical intergenerational gap found in most family businesses may not be as wide as initially assumed. As the current leader of the family business, Carlo’s willingness to take risks and trust his sons with Rivera’s future is a key contributing factor to the winery’s gleaming triumph.

Sustainability plays a significant role in the de Corato family’s innovative business vision. Carlo proudly declared that 35% of their energy comes from solar power, and that they invest annually in new technologies that support sustainable farming and winemaking. Ultimately, the family’s deepest respect for the natural processes allow them to uphold environmental sustainability in a commercially favorable manner.

Effective family business succession is never easy. Thus, having a clear business strategy for renewed commitment across generations is vital for long-term survival. The de Corato family’s ambitious winemaking philosophy has enabled them to emerge from uncertainty with greater resolve. What remains unchanged is their commitment to create quality Rivera wines that uphold the family legacy in a sustainable manner.

Entrepreneurship

Rising to the challenge

An interview with Anmol Sood, Owner of Tech and manufacturing businesses, discussing about the new demands COVID-19 created in the tech sector and how his businesses are helping tackle global health crisis in recent history. He also talks about the heightened importance of resilience during COVID-19.

Part I: How the tech and manufacturing sector responded to the biggest call in the face of COVID-19

Anmol, technology has never played such an important role in how we live and operate. Your businesses, Jaltek, Equivital and Wavesight work to deliver cutting edge technology in a range of sectors such as clean energy, medical and defence as well as aerospace. Tell us about your businesses and the impact of COVID-19.

About our businesses |

Jaltek Systems Ltd – Looks at the design and manufacture of high end, complex technology products and systems for customers in the defence, civil aviation & industrial sector. With defence, aviation & medical approvals in place, the range of products that are being manufactured is extremely diverse, which was important in navigating through the economic shock of the COVID-19 pandemic. |

|

Equivital – Here we design wearable technology solutions for professional organisations around the world including global militaries, first responders, clinical research and industrial customers. With existing FDA and intrinsic safety approvals in place, our current product range includes clinical grade wearable sensors to collect & aggregate human, environmental & geo-location data as well as mobile and web applications to view data in real time. We have also developed proximity monitoring solutions, initially used for social distancing purposes with data available for contact tracing, soon to be used for proximity monitoring between workers and potentially dangerous plant and machinery. |

|

Wavesight – this business specialises in the supply of critical wireless infrastructure where we supply wireless infrastructure products and services such as radios to transmit video, voice & data, ruggedized communications products and solar power solutions, delivering low-cost power around the world. |

Our businesses are focussed on delivering technology related solutions for our clients. From a manufacturing perspective, companies who have medical approvals are definitely seeing a rise in demand and interest, but one of the biggest challenges facing the whole industry is the lack of availability of components, globally. It is difficult to know when this supply chain is going to open back up fully, but we can definitely see the signs of recovery already.

Our Jaltek factory has remained open throughout the pandemic with our amazing team going into work every day in order to meet deadlines. We saw a strong financial performance between April and June and continue to see growth in the next quarter. Even during these times, we have seen that our services have remained in high demand.

Jaltek was asked to manufacture critical medical equipment for COVID-19. Can you tell us more?

We have long standing relationships with some large UK companies who when the government put out a request for help in supplying ventilators, were more than keen to help.

Thanks to our existing approvals, we were actually contacted by four different groups and consortiums. It was amazing to see how quickly these companies were able to produce and finalise designs for critical medical equipment, such as ventilators, and we were honoured to play a part in that.

Fortunately, the National Health Service (NHS) was able to cope with the demand for ventilators without further support from the private sector. The designs that we helped to prototype are now being transitioned to other countries, where the demand for ventilators remains high.

The UK Government also asked for your help in producing Personal Protective Equipment (PPE) for the NHS and social distancing tags?

Our business, Equivital, produces FDA approved wearable technology for researchers, the military, first responders, as well as industrial companies. We came up with four clear strategies for how our products, services and experience could help:

1. Our research products are being used to assist with research groups globally who are trying to better understand the virus and look at potential vaccines and treatments for it. Our clinical grade wearable technology means that data can be collected from a wide cohort of subjects who are potentially in different locations and can send that data back to the researcher. We are also allowing multiple groups, who are building home healthcare monitoring platforms, to integrate our sensors into their platform.

2. Our Blackghost application that is already being used to provide safety and performance monitoring for military, first responders and industrial personnel has been adapted. As well as physiological and geolocation data, we can take spot measurements for temperature and SPO2. SpO2 is also known as oxygen saturation and is a measure of the amount of oxygen-carrying haemoglobin in the blood relative to the amount of haemoglobin not carrying oxygen. The body needs there to be a certain level of oxygen in the blood or it will not function as efficiently. If the data points measuring this are below certain thresholds, steps can be taken to limit risk within the overall workforce. As many first responders are wearing PPE during the pandemic, our wearable technology is providing valuable data to ensure they do not keep working past a safe point, measuring fatigue and heat stress.

3. Being able to adapt and pivot, we prioritised the development of our latest product that is a small device worn by individuals. If two or more individuals, who are both wearing the device, come within 2 meters / 6 feet of each other (distance is configurable by organisation), an alert will be triggered with a visual and vibrating indication until the wearers move to a safe distance. This device means organisations can start bringing employees back to work, in office, retail, warehouse, construction and other such settings, safely. As data from these devices can be stored and downloaded, further analytics can be obtained, such as contact tracing, heat maps, hot spots amongst others meaning a whole organisation does not need to isolate in case of an individual diagnosis.

4. We've designed and commercialised FDA approved products - we were approached by some of our existing customers to source various forms of PPE that are so sought after globally. We have now built up an entire supply chain that is able to provide a range of PPE (masks, gloves, gowns etc.) to customers in the UK and globally.

Part II: Responding to COVID-19 when you’re an entrepreneur

Resilience is a key trait of entrepreneurs, as is flexibility and adaptability. You had to change your original plans for this year, what does resilience mean to you and what advice would you give to other entrepreneurs on how to remain resilient during these times?

Any good business plan must have the ability to adapt, built into it. It is very rare, even if there isn't a global pandemic, that the assumptions you built your business plan on at the start of the year (or earlier) remain valid throughout the period of performance. So the ability to react to a changing environment is something we pride ourselves on. Similarly, if the entrepreneur behind a business is not able to adapt or react to change, the execution of that business plan becomes fraught with risk and uncertainty.

Each of our businesses had to adapt at the start of this pandemic and that is continuing even today. Key strategic activities we were undertaking had to be put on hold; we had to make sure that we were solid and secure as a business, to weather this storm. I’m thankful that until now, we have not had to furlough any staff, even though we had the option to do so. Our ethos is that if we are able to carry on funding our operations ourselves, there are many businesses that can’t and need government assistance, so why divert potential financial support from them?

In addition to this, I've always believed that during times of crisis, businesses that survive come out of that period so much stronger. These are the businesses that are able to pivot to deliver compelling value propositions that are related to their core business mission and vision, but are adapted to satisfy the changing current and future demand. So whether it is our manufacturing business, Jaltek, that placed a heavier focus on our medical expertise to assist with the provision of key medical equipment or whether it is Equivital, where we expanded our product ecosystem to include social distancing and other monitoring capabilities, we have tried to adapt to the current situation, but also staying true to who we are and what we want to build in the future.

There is no doubt that these new focus areas for each of our businesses will remain as an addition to our core business, but they will also need to adapt. For example, once the social distancing protocols are relaxed and/or removed, our social distancing devices can become proximity sensors that help to prevent accidents between humans and machinery, on industrial and construction sites around the world.

How has it felt to be an important factor in supporting the fight to combat COVID-19?

This pandemic has been an awful event, unprecedented in the effects it has had on our globalised societies and economies. The global economy will take years to get back to pre-pandemic levels, with statistics such as GDP decline and unemployment numbers showing how badly we are being impacted. The effects of the massive interventions that central banks and governments have had to resort to will be felt for decades by taxpayers and that's just one aspect of the economics picture. Social economics, health economics and behavioural science studies show that there are challenges across every aspect of our lives.

However, I believe there will be benefits as we come out of this crisis as well. Firstly, as a society, we will not take for granted our ability to meet friends, go to the restaurant, see family etc. Secondly, pre pandemic, technology was important but was almost seen as a convenience in certain sectors such as video conferencing, fitness and some retail segments. Now that people have realised its value, the true benefits of technology are being more widely understood. As an example, I can't travel to meet customers and staff but using Microsoft Teams actually allows me to be more in touch with people all around the world, more regularly. Online shopping, streaming services for entertainment, virtual fitness classes, all of these have become the norm and have created what is being called the "stay at home economy". This will hopefully last post pandemic and actually lead to greater efficiencies for us all.

From a personal perspective, it is inspiring to see our businesses being able to assist during this pandemic. We've always maintained that the ability to positively impact people's lives is the greatest success a business can have. We are also very clear that we are not aiming to unfairly profit from this situation which is why we have reduced pricing and margins in a number of areas that means our services are more widely accessible globally.

Providing help runs in the family with your sister, Ekta now providing healthcare support in UK hospitals. Ekta can you tell us more?

When I saw the situation in Italy or Spain and knowing that in the UK we were between 2 and 4 weeks behind, it was a natural reaction to offer help to my medical colleagues. With the government launching a comprehensive medical returner programme, the process was fairly easy. As I haven't practised for a number of years, I was first issued with a license to practise by the GMC. Since then I have undertaken training to work at the Nightingale hospitals and will be further deployed in a North Central London hospital based on clinical need. The acute need was dealt with really well by the NHS planners and government, but there is now a large backlog of normal patient care work that doctors like me, will hopefully help clear quickly. I would like to hope that people who have waited for procedures or appointments are able to be seen quickly and their needs dealt with efficiently.

Perspectives

Investing in the Digital Economy

As technology and economic growth become increasingly linked, not investing in digital capabilities is now a significant risk.

While digital innovation and transformation have been underway for decades, the volume and speed of recent technological advances is accelerating transformation across all aspects of society, with significant impact on economic sustainability. Looking at the disruptive impact of the COVID-19 pandemic, it's clear that many of the trends that came into play as a result, have the potential to permanently alter the global business and economic landscape.

As technology and economic growth become increasingly linked, it's critical that technology investments generate revenues, drive productivity and reduce cost. This imperative is heavily influencing investments across the spectrum of consumer services, business services, infrastructure, logistics, healthcare, financial services, and other sectors. Economists commonly refer to the concept of creative destruction; wherein, with each recession, those parts of the economy that break down are replaced with new innovations that move the economy forward. In the case of COVID-19, creative destruction is in the spotlight. The profound changes we are seeing as a result of this disruption will likely impact the way we work, play, learn and interact well into the future.

In the early days of technology evolution, developers focused on task implementation: word processing, data manipulation in spreadsheets, data transmission, etc. New functionalities were born and the technologies permeated homes, businesses and institutions, but for a long time, the amount of true innovation was limited. Cyclical forces such as the employment rate and capital spending influenced the ebb and flow of spending on new technologies, considered a risk within the broader economic context.

However, with more recent advances in digital capabilities, including web-based software, powerful smartphones, artificial intelligence, Big Data, 5G and streaming, technology adoption has become pervasive and productivity enhancements are quite significant – making technology a secular growth trend.

Now, not investing in digital capabilities is a significant risk.

Innovation, Growth and Disruption – Five Key themesThe companies that will succeed in this environment can span sectors, industries and product groups across the economic landscape. Some will create structural growth by delivering innovative products and services that utilize digital technologies. Others will develop disruptive technologies that upend how long-established businesses provide services to their markets. Still others will deliver solutions that anticipate and address shifting consumer and corporate demand as individual and company behaviors evolve.

What unifies the opportunity for all of them is a set of drivers that will shape how they respond to digital innovation.

1. Digital Consumer – Consumer expectations and consumer behavior have shifted dramatically as all aspects of our lives can be captured, organized and facilitated via digital technologies. eCommerce, Social Media, Advertising and Streaming are just some of the examples of how the landscape has been disrupted, forever altering how people access and interact with information and content, and how those who are sharing information are taking feedback on that content.

2. Digital Services – More and more companies and institutions are using technologies such as cloud computing, SAAS, Artificial Intelligence, Big Data and Remote Access/Remote Working to drive productivity during an incredibly challenging time. Whether you are a provider or a user of services, the services of today and the future look quite different from how they looked a decade ago.

3. Infrastructure – infrastructure lies at the center of the digital eco-system as the speed and volume of activities accelerate. Semiconductors, Handsets, 5G, Data Centers, Towers, reliable power generation, etc. all play a crucial role in support of consumer and corporate demands.

4. Fintech – Electronic and Contact-less payment activity has been growing for many years and the COVID-19 pandemic has re-accelerated a focus on the cash-less society. Advances in algorithms and AI are leading to new products for mortgage origination, insurance, security trading and investment advice. As financial services firms seek to offer services to younger members of society (Millennials), the mechanisms and the safety of the delivery of services must evolve to meet their demands.

5. Healthcare – the medical field certainly came into the spotlight as a result of the COVID-19 pandemic, and continues to transition toward greater utilization of digital technologies in the fields of tele-medicine and medical records, diagnostics and testing, genetics, robotic surgical procedures, and research data.

Public vs Private MarketsFor startup companies developing innovative, cutting-edge digital technologies, there's an increasing amount of private capital available from Angel, Venture and Private Equity investors – both in the early stages of development and in subsequent rounds of raising capital. Companies that can successfully navigate multiple rounds of capital raises can afford to wait longer before entering the publicly traded markets. Once they do, they are further along with development of their products and services and can often demonstrate greater sustainability and credibility, as well as a clearer path toward profitability. For investors, this means that they can seek to capture early stage returns from the private markets, before turning to the public markets.

Post Covid-19 WorldWhile the pace and duration of the current pandemic remains unknown, the landscape for adoption and utilization of digital products/services is likely to be forever altered. We have seen in so many instances that the path to a resilient economy, during uncertain times, is through innovation and adaptation. This path to the future runs through many sectors and industries, but it's likely that those best situated to leverage digital solutions will experience the greatest success.

Plugging into the future

Electric cars are no longer a niche market. Climate action and consumer pressure are accelerating progress towards a tipping point for clean energy. How can investors get on board?

The UK has begun consultation on bringing the date of its ban on the sale of petrol, diesel and hybrid cars and vans forward from 2040 to 2035.1 For France, the deadline for banning the sale of cars powered by fossil fuels is 2040.2 Scotland has set its own date of 2032, although hybrids will still be permitted.3 Germany and the Netherlands are aiming for 2030. Norway is more ambitious still, with a 2025 target.4

None of these dates is yet enshrined in law; some are firm intentions, others are hazier 'policies'. But the direction is clear. All these countries intend to ban production of petrol and diesel vehicles. Other major economies, such as China, are still considering their own target dates.

The days of the internal combustion engine are numbered. In its place will come electrification: clean public transport, combined with electric and battery-driven road vehicles. (Hybrid cars, which combine conventional engines with an electric motor, seem set to have a reprieve for now, in some countries.)

Climate and cost driversIt's not so long since electric cars were dismissed with jokes about 'shocking' prices, or the length of the extension cord that drivers would need. Few petrolheads are laughing today.

The speed of the shift has been triggered by various factors, including the pressure on countries to reduce emissions and meet the legally binding 2015 Paris Agreement on climate change.

Transport, responsible for about 23 per cent of global greenhouse gas emissions, is an obvious target for action. Many city leaders are already restricting diesel use, imposing congestion charges and expanding the availability of charging points for electric vehicles.

The recent lockdown also had a dramatic effect of pollution levels, which were down some 30 per cent in the world's COVID-19 hotspots as mobility dropped around the world.5 People have seen knock-on benefits in the reduction of noise, better air quality and the growing prevalence of wildlife.6

At the same time, the cost of the technologies required has been falling, making clean energy more attractive. The cost of producing one megawatt-hour of electricity using solar is now USD50 – less than half that of electricity using coal,7 with the cost of generating renewable power falling rapidly over the past 10 years and renewable energy projects proving cheaper than even the most inexpensive coal-fired power plants.8

Critically, battery costs are also in decline. The cost of running lithium-ion batteries, now seen as the standard for electric vehicles, has fallen by 75 per cent over eight years. Analysts have calculated that each time battery production doubles, costs fall by a further 5 to 8 per cent.9

Consumers buy inIf policymakers have decided that electric vehicles are the future, drivers – and the markets – aren't far behind.

In China alone, 770,000 electric vehicles hit the roads last year, a 50 per cent increase. By 2025, one in every six cars sold worldwide is expected to be an electric vehicle.10 The traditional automobile companies can see the writing on the wall. Most have their own electric models in development. In 2019, analysts calculated that the big car makers were investing over USD90 billion in what remains, for now, a relatively tiny market.11

Giants vs. newcomersThe legacy manufacturers are up against a host of agile start-ups which have gained the attention of investors.

The diverse suppliers of components for electric vehicles are also attracting interest. Like the carmakers themselves, suppliers have had to make a judgment on how far and how quickly to jump into the electric vehicle market.

Ride-hailing companies are entering the market too, many of them devoting parts of their fleets to electric cars. Besides boosting demand, this will have the effect of getting consumers accustomed to using electric vehicles – an important step towards mainstream adoption.

Supporting technologiesBeyond the car plants, there are opportunities in related fields. Those in the battery supply chain who can successfully feed the growing demand stand to gain.

Electric charging networks will be a growth market too. A host of companies are vying to set them up. A few carmakers are establishing their own networks to help broaden the appeal of their products, rather than rely on third-party providers.

Other innovators are seeking ways to enhance the efficiency of electric vehicles. Vehicle-to-grid technology, for example, could allow parked vehicles to charge their batteries, or to discharge their batteries back to the grid.

Investment in the raw components required by electric vehicle systems, including copper, lithium and cobalt, may be another useful angle to explore. Even allowing for current attempts to reduce cobalt content in batteries, the cobalt demand for electric vehicles is expected to grow 25 times by 2030.12 Mining companies are stepping up production specifically to meet clean transport demands.

Risks and rewardsThe opportunity posed by charging networks is also one of the risks: the lack of charging points is seen by consumers as the major barrier to the adoption of electric vehicles.

The development of speedier charging will also be critical, enhancing the appeal by offering long-distance travel. Only a quarter of the 430,000 publicly accessible chargers worldwide in 2017 were 'fast' – that is, taking around 30 minutes to charge.

More widely, the stance of the current US administration on climate change and its withdrawal from the Paris Agreement is a source of uncertainty for the future of this sector. From carmakers to suppliers and grid operators, there are multiple opportunities, but neither newcomers nor traditional players can be assured of success. Those who blend great design and innovation with efficient production techniques are most likely to reap rewards.

In a crowded market, there are bound to be losers as well as winners, so investors need to be selective. Speak to your Relationship Manager about a strategy for investing in clean transport.

1 Govt.uk, Consulting on ending the sale of new petrol, diesel and hybrid cars and vans, February 2020

2 Reuters, France to uphold ban on sale of fossil fuel cars by 2040, June 2019

3 AutoExpress, Scotland to ban petrol and diesel car sales by 2032, September 2017

4 Countries are announcing plans to phase out petrol and diesel cars. Is yours on the list?, World Economic Forum, September 2017

5 Sciencedirect, COVID-19 pandemic and environmental pollution: A blessing in disguise?, August 2020

6 News Medical, Improvements in air quality and health during COVID-19 lockdown, April 2020

7 Lazard's Levelized Cost of Energy Analysis – Version 11.0, Lazard, 2017

8 World Economic Forum, Chart of the day: Renewables are increasingly cheaper than coal, June 2020

9 Electric carmakers step up pursuit of enhanced EV batteries, Financial Times, September 2018

10 One in Six New Cars in the World Will Be Electric By 2025, Bloomberg, November 2017

11 Global carmakers to invest at least USD90 billion in electric vehicles, Reuters, January 2018

12 Global EV Outlook 2018, International Energy Agency, 2018

Insights

Asia’s tectonic demographic shifts

Tectonic shifts are taking place in Asia. Mainland China will soon no longer have the world’s largest population. Asians are getting older, living longer, and flocking to mid-tier cities. Women are having fewer children and working more; households are getting smaller.

These population changes are already having an impact on lifestyles and consumer spending. Here we highlight 10 key trends in Asian demographics that businesses and investors in the region should have on their radar.

1. India overtakes mainland ChinaBy 2030, India is expected to become the most populous country, with mainland China’s population starting to shrink. Companies need to consider the implications well before this happens: for instance, can they offset slower volume growth by offering better quality products at higher prices.

2. Falling populationsVery low fertility rates may become common but slowing population growth does not necessarily mean a shrinking labour force. While Japan’s populace is falling, its workforce has been growing since 2013.

3. Empty-nestersThe combination of an ageing population, children leaving home and more women working is a powerful force in mainland China. These ‘empty-nesters’ are one of the world’s largest demographic shifts: they buy more premium products – better quality at higher prices – on almost everything from food and clothing to home furnishings.

4. Shrinking householdsThe proportion of single-person households in South Korea is estimated to reach almost 33 per cent by 2030. This changes spending patterns – more discretionary consumption and ready-to-eat meals from convenience stores. Expect similar trends in Taiwan and parts of mainland China.

5. More working womenThis trend is especially pronounced in mainland China and Indonesia, where more women are completing higher education and getting managerial jobs. This boosts household income and impacts how families spend their income.

6. Mid-tier cities

6. Mid-tier cities

Employment and spending is growing in mid-tier cities, especially in India and the ASEAN nations of Southeast Asia, creating a new group of consumers in lesser-known cities and towns.

7. Online shoppingSoutheast Asia’s internet economy is expected to triple to USD300 billion by 2025. Coronavirus has accelerated the trend, with more customers ordering online for the first time. ASEAN and India, in particular, should see rapid increases in online penetration.

8. Traditional medicineRising interest in health is renewing attention on traditional products. Exports of traditional Chinese medicines rose 270 per cent over the past decade while Indonesia and India’s traditional healthcare industries are booming. However, diabetes is a key threat: associated risks are high in the Philippines, Indonesia, and India.

Read more analysis on Asian demographics and health on the HSBC Global Banking & Markets

9. Bikes are backWith people choosing healthier lifestyles and keen to avoid public transport due to COVID-19, demand for bicycles is rising. Asia, especially Taiwan, has some of the best cycle designers and component makers.

10. Asset accumulationAsians are living and working longer, allowing a greater accumulation of wealth to finance an extended retirement. It may be prudent for them to plan for a time when families are unable or unwilling to care for older members. That may require new types of insurance, care and financial products.

Emerging Asia’s post-COVID future

Asia’s emerging economies are at different stages in combatting the COVID-19 pandemic. For some, like Thailand, the light at the end of the tunnel is getting brighter as social distancing measures are being eased and economic activity is starting to ramp up again. Others are still grappling with outbreaks and lockdowns.

Whatever stage they are at, though, these markets must also continue to think beyond the crisis, and about what can be done to safeguard and improve their long-term economic prospects.

Developing nations across Asia – Thailand included – have of course not been immune to the social and economic disruption caused by COVID-19. Travel restrictions and distancing measures have hit trade and jobs around the globe. Budget deficits have widened and overall levels of debt will continue to increase across much of the region.

Despite the near-term challenges, it’s important to remember the underlying trends that underpin many developing nations’ long-term growth potential.

For one thing, most of emerging Asia enjoys favourable demographics. For another, the region’s economies are increasingly capable of delivering innovation and higher-end manufacturing and services.

It’s also important to remember that emerging Asian economies are, broadly speaking, now more resilient to external financial shocks than during the 1997-1998 Asian financial crisis or the 2008 global financial crisis.

And as the 2020 crisis picked up steam, governments and central banks were quick to provide assistance. In Thailand, the Finance Ministry and Bank of Thailand announced a number of relief measures to cushion the impact of COVID-19 – from interest-rate cuts and soft loans to payment holidays, and a new corporate bond stabilisation fund. The cabinet also approved in principle a THB22 billion (around USD700 million) package to stimulate domestic tourism.

Still, with COVID-related obstacles set to linger, policymakers would do well to supplement their immediate economic support measures with bold steps aimed at increasing their economies’ attractiveness as places to invest and do business.

There are three broad areas of focus.

First, improving the local operating environment – making it easier to do business. That spans everything from reducing red tape and corruption to dialling back restrictions on incoming investment and labour market reforms. Many countries have made laudable progress on these fronts, and building on this will stand them in good stead.

Second, boosting competitiveness and productivity through investment. Specifically in transport and energy infrastructure, telecoms and internet connectivity, healthcare, education and smart, low-carbon ways to manage urbanisation. Building infrastructure well from the outset – and building back better after each upset or crisis – is crucial to each economy’s long-term growth and resilience.

Linked to this is the third area, of climate change preparedness. Southeast Asian and South Asian nations are particularly vulnerable to the effects of climate change, with low-lying megacities like Jakarta, Bangkok and Mumbai highly susceptible to storms and sea level rises.

The COVID-19 pandemic has taken a human and economic toll that was unimaginable just months ago. Its impact will linger for months, if not years. But like every crisis, it also represents an opportunity for policymakers and business communities to rethink and accelerate their reform agendas.

Those that grasp the opportunity could not just move their economies to the proverbial light at the end of the tunnel, but bolster their solid fundamentals for the world well beyond it.

Note: This is an edited version of an article that first appeared in The Bangkok Post on 21 July 2020.Power your retail banking needs with HSBC Jade today

Jade is more than a precious gem. For centuries, this symbol of wealth and protection has been passed carefully down through generations. With its treasured place in Chinese culture, the stone was the natural inspiration for HSBC Jade. As an HSBC Private Banking client, you gain access to the world of Jade through your retail banking account1.

With an HSBC Jade account, your status will be recognised in mainland China, the US, Canada, Singapore and France. Check out our HSBC Jade Centres in Hong Kong and Singapore, offering you a comfortable, confidential space to meet privately with your HSBC Relationship Manager, plan your next move or simply take care of the day’s banking needs. Apart from Hong Kong and Singapore, you can also have access to the HSBC Jade Centres in mainland China, the US, Canada, and France.

Giving a green light to worldwide convenienceSpeaking of overseas, wherever your travels take you, count on HSBC Jade to make life easier and more rewarding with retail banking products and services, like our HSBC Jade Debit Card and HSBC Jade Passport. Exclusive to Jade clients in mainland China, Hong Kong and Singapore, your Jade status entitles you to Jade exclusive products, services and privileges without the need to maintain local minimum eligibility requirements.

Whatever the situation calls forAn additional benefit through your HSBC Jade account is access to our HSBC Jade concierge service. Powered by the resources of Ten Lifestyle Group2, our concierge service brings to life the delights of tailored moments and memorable lifestyle benefits at your fingertips. From direct booking of flights, hotels and travel experiences to invitations, private events and more, our concierge service was created to help you explore your passions.

We’ve barely scratched the surfaceSpeak with your HSBC Private Banking Relationship Manager to open a HSBC Jade account or if you are an existing retail client, upgrade your account to HSBC Jade now.

1 Terms and conditions apply. For more information, reach out to your Private Bank RM

2 HSBC Jade clients will enter into a direct agreement with Ten Lifestyle Group PLC under which Ten Lifestyle Group PLC and its affiliates will deliver the lifestyle service available under the HSBC Jade concierge service. HSBC

will not be a party to that agreement and will not be responsible for the delivery of the lifestyle services. The HSBC Jade concierge service digital platform is owned and operated by Ten Lifestyle Group PLC.